Sustainability for Aramco is adding value to society

Sustainability for Aramco is adding value to society

When Aramco published its 2022 Sustainability Report in June this year, it outlined in detail how the company is progressing with regard to sustainability.

From the amount of investment and number of projects the company has undertaken and plans to implement, there is a strong realisation that sustainability is a key benchmark going forward.

In fact, in its Q2/H1 financial report, Aramco has cautioned that factors, such as climate change, could cause actual results to differ materially from Aramco’s expectations.

Amin Nasser, the company’s President and CEO, said: "Over the last year, there has been increasing acceptance of the fact that there needs to be a better balance between maintaining energy security, energy affordability and environmental sustainability. As you will see in this year’s (2022) Sustainability Report, Aramco has strengthened its unique and central role in providing the world the reliable energy it requires for an orderly energy transition."

Aramco’s company’s vision is to be the world’s leading integrated energy and chemicals company, operating in a safe, sustainable and reliable manner.

But that requires tremendous efforts, and something that Aramco is doing diligently.

The Sustainability Report sets out Aramco’s plans across the environmental, social, and governance (ESG) spectrum, and describes how the company is delivering on these areas.

During 2022, Aramco participated as a lead bidder in the largest-ever voluntary carbon credit auction, held by the Regional Voluntary Carbon Market Company (RVCMC) in Nairobi, Kenya.

Over 2.2 million tons of high-quality carbon credits were sold at the auction. The purchase of carbon credits enables Aramco to offset some of its emissions, supports the establishment of a credible and functioning Saudi-based regional voluntary carbon market, and is one of the Company’s five levers to achieve GHG emissions reductions by 2035.

Meanwhile, Aramco and its partners produced International Sustainability and Carbon Certification + (ISCC+) certified circular polymers from plastic waste derived oil at SATORP – a Mena region first.

Aramco is also supporting local industries through its In-Kingdom Total Value Add (iktva) programme and helping develop new industries in the Kingdom under its Namaat industrial investment programme.

This will further localise its supply chain and reduce reliance on imports, thus adding to sustainability of the supply chain.

TECHNOLOGY AND LOWER CARBON INITIATIVES

Aramco has no qualms in saying that it is investing to increase its maximum sustainable oil production capacity to 13 million barrels per day (mbpd) by 2027. It is also growing its gas production, potentially increasing it by more than half through 2030 with a mix of conventional and unconventional gas.

But at the same time, it is also working to lower its upstream carbon intensity, gas flaring intensity, and methane intensity in line with its net-zero by 2050 goal.

Along with intensity targets, Aramco is aiming to reduce its net annual Scope 1 and Scope 2 GHG emissions from both the upstream and downstream businesses by 52 MMtCO2e by 2035.

And to reduce the carbon footprint of conventional energy as well as improve energy intensity across its business, technology will be a critical enabler for this.

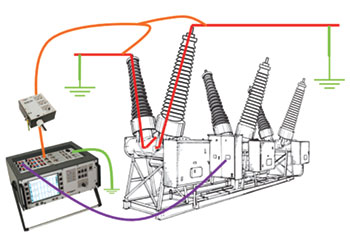

Efforts are being made to advance key enabling technologies, particularly CCS, which is mission-critical to a sustainable future.

As part of its long-term strategy of investing in innovative solutions to achieve lower carbon and lower energy intensity, Aramco has set up a new $1.5 billion Sustainability Fund to invest in technologies needed to address climate challenges.

In March, at the China Development Forum 2023, Nasser said Aramco was steadily adding lower carbon energy to its portfolio, especially blue hydrogen and blue ammonia, electrofuels, and renewables. In addition, the entry into liquified natural gas (LNG) was also being studied.

Aramco plans to reduce the net carbon emissions of its operations and to support the global energy transition through the development of lower carbon products and solutions across the energy, chemicals, and materials sectors. It is also investing in renewables to support of the Kingdom’s National Renewable Program.

Some of the projects that Aramco has already started or are in the pipeline to reduce emissions include:

• Renewables: Investment in 12 GW of solar and wind energy by 2030. Sudair Solar PV Plant has reached 56 per cent completion with power generation expected to start in Q4, 2024.

• CCS: An agreement was signed in 2022 with SLB and Linde to build the Jubail CCS hub, which will capture up to 11 MMtpa by 2035 — contributing towards the Kingdom reaching its goal of 44 MMtpa of CCUS by 2035.

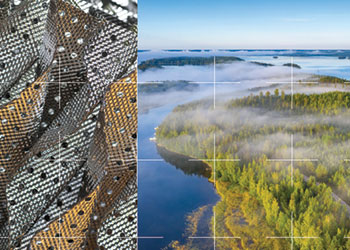

• Offsets: Plant 300 million mangroves in Saudi Arabia and 350 million mangroves outside the Kingdom by 2035. This is expected to remove and offset an estimated 16 MMtCO2e by 2035.

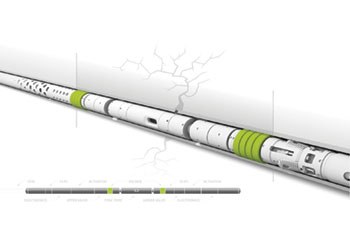

• Flaring: During 2022, Aramco decreased flaring by 17 per cent due to significant investments, installations and improved operations of flare gas recovery systems.

In conclusion, Aramco recognises the challenge of sustaining its business and supporting the world’s climate ambitions.

But as Yasir Al-Rumayyan Chairman of Aramco’s Board of Directors, said: "When we talk about sustainability at Aramco, we understand that it is about balancing the economic benefits to our owners, the social value and utility that our activities and products generate for customers and consumers, and minimising any negative environmental and social impacts, to build something that will last: a company that will still be standing strong, generations from now."