Extracting minerals needs regional and international collaboration

Extracting minerals needs regional and international collaboration

The Kingdom stands at a crucial time where collaboration, innovation and sustainable mining

The Kingdom of Saudi Arabia is aiming to become a global mining and mineral processing hub, and is dedicated to securing strategic minerals, promoting economic development, and boosting global supply chain resilience.

The country's Vision 2030 prioritises industrial and mining sector growth, recognising mining as a third economic pillar.

This message was sent out when KSA participated in August in the ‘1st Symposium on Critical Minerals Outlooks’, co-hosted by the International Energy Forum (IEF) and Future Minerals Forum (FMF), where leading international organisations and industry sources presented and compared recent outlooks for critical minerals supply and processing capabilities.

KSA is a member of the IEF, which is the world’s largest international organisation of energy ministers with members from 72 countries.

KSA is sitting on an abundance of minerals, but extracting them sustainably would necessitate both regional and international alliances.

Khalid Al-Mudaifer, Vice-Minister for Mining Affairs, Ministry of Industry and Minerals Resources, Saudi Arabia, said at the symposium: 'Our shared green future and energy transition ambitions require that we find new and stable sources for critical minerals. We believe that the mineral-rich super region, which stretches from Africa to West and Central Asia has tremendous potential to become a game changer in developing resilient and responsible mineral value chains.'

KSA has an estimated mineral wealth of $1.3 trillion. The Arabian Shield within Saudi Arabia, which spans over an area of 600,000 sq km, is a major source of precious and base minerals. To date over 48 minerals have been identified in the Kingdom with, at least, 15 minerals that are commercially viable.

According to estimates, the country has gold reserves worth 56,263,984 ounces with a gross in-situ value of $69 billion; copper deposits of 2,243,000 tonnes ($17 billion value); zinc deposits of 4,383,900 tonnes ($9 billion); lead deposits of 448,900 tonnes ($0.8 billion); silver deposits of 95,938,000 ounces ($2 billion); and 108,000 tonnes of nickel deposits with a gross in-situ value of $1.6 billion.

However, Saudi Arabia needs the right partners and technology to tap those reserves in an efficient and sustainable manner.

In June, Bandar Al Khorayef, Minister of Industry and Mineral Resources of Saudi Arabia, told the audience at Vision Golfe, a GCC-France trade event held in Paris: 'I think no one believes that a sector like mining can be unlocked by a single country; you need collaboration with everyone.'

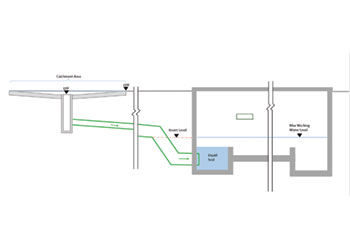

He said they are in discussions on a regional level with other GCC member countries to see 'how we can complement each other with regard to logistics and processing, finished goods and adding value in different value chains'.

In January, Ma'aden, Saudi Arabian Mining Company, formed a joint venture with the PIF to invest in the iron ore, copper, nickel, and lithium sectors globally. Additionally, the Kingdom has built an entire city for processing and finishing aluminium.

According to Robert Wilt, CEO of Ma’aden: 'We need five times as much aluminum and seven times as much copper. We need to produce as much copper in the next 20 years as we did in the last 150 years, and we need to find things twice as fast and process it. 'At Ma’aden,' he said, 'we need to cut down the time, from exploration to commissioning, from 20 years down to 9. And you can’t do that without significant innovation.'

SECURITY OF MINERALS IS CRUCIAL FOR ENERGY TRANSITION

Experts at the symposium emphasised that the global community is concern over the lack of essential minerals needed for the energy transition and that this could hinder the achievement of shared climate goals.

More critical minerals are needed for electrification and the deployment of other clean energy technologies such as low-carbon hydrogen. However, mining and metals sectors face significant constraints, including social, environmental, and financial issues.

Also, to ensure rapid, equitable and orderly transitions to net-zero carbon emissions, decision-makers in these sectors must better understand the demand and supply of energy and minerals.

As the global energy system transitions towards clean energy, it is necessitating an evolving approach to energy security.

As countries and companies strive to reduce their greenhouse gas emissions, a variety of clean energy technologies are being deployed, relying on critical minerals like copper, lithium, nickel, cobalt, and rare earth elements.

However, these markets for key minerals could be affected by price volatility, geopolitical influence, and supply disruptions.

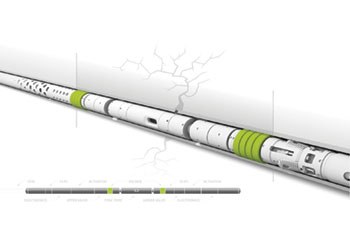

The construction of solar photovoltaic plants, wind farms, and electric vehicles (EVs) requires more minerals than fossil fuel-based systems. And this is helping the energy sector emerge as a major force in mineral markets, with clean energy technologies becoming the fastest-growing segment of demand.

In a scenario that meets the Paris Agreement goals, clean energy technologies' share of total demand could rise significantly over the next two decades, to over 40 per cent for copper and rare earth elements, 60-70 per cent for nickel and cobalt, and almost 90 per cent for lithium.

However, current supply and investment plans for many critical minerals fall short of what is needed to support the accelerated deployment of these technologies. The rapid increase in demand for critical minerals raises questions about the availability and reliability of supply.

Higher mineral prices could have a significant effect on battery costs, as well as on electricity networks, where copper and aluminium currently represent around 20 per cent of total grid investment costs.

Concerns about reliable and sustainable minerals for the energy transition require clear signals from policy makers and long-term visibility.

The International Energy Agency (IEA) recommends six key recommendations: Adequate investment in diversified sources, promotion of technology innovation, scaling up recycling, enhancing supply chain resilience, promoting higher environmental, social, and governance standards, and strengthening international collaboration.

The world is expected to see a significant increase in demand for mining in general and critical metals, which will be key to the electrification of the global economy. Innovation is key in meeting the Paris climate goals in the next 25 years.