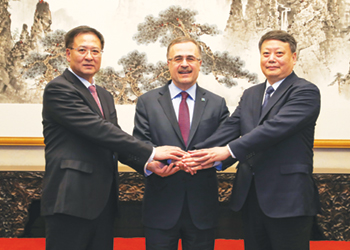

Aramco signs deal with Norinco

Aramco signs deal with Norinco

Aramco, already the only Mideast national oil company with a stake in

an existing Chinese refinery looks to entrench its position in China

Saudi Aramco took a major step toward its second big downstream investment in China, signing up for a joint venture with military-backed Norinco and independent refiner Panjin Sincen to develop an integrated refining and petrochemical complex in northern China’s Liaoning province worth more than $10 billion.

Aramco also signed an agreement to acquire a 9 per cent stake in the giant 800,000 bpd Zhejiang Rongsheng refining and petrochemical complex, expected to start trial runs this year, according to Reuters quoting Saudi state news agency SPA.

Aramco, already the only Mideast national oil company with a stake in an existing Chinese refinery—a 25 per cent interest in the 240,000 bpd Fujian complex—looks set to entrench its position in China with a 35 per cent stake in the 300,000 bpd refining and petrochemicals complex in Liaoning’s Panjin city, which was first discussed two years ago.

The deal was signed during Saudi Crown Prince Mohammed bin Salman’s two-day visit to China, the third stop of an Asian tour that has also seen Saudi Arabia pledge $20 billion in investments in Pakistan and $100 billion in India.

But Aramco’s plans for the downstream complex in Liaoning’s Panjin city seem more advanced than the refinery pledges made in Pakistan and India.

The three partners will create a new company, Huajin Aramco Petrochemical Co. in which Aramco will hold a 35 per cent stake, Norinco a 36 per cent interest and Panjin Sincen a 29 per cent stake. The complex will include a 300,000 bpd refinery with a 1.5 million metric tonne per year ethylene cracker and a 1.3 million tonne/year PX unit.

The Saudi giant will supply up to 70 per cent of the crude feedstock for the project, which is expected to start operations in 2024. There are additional plans to establish a fuels retail business.

Large Mideast oil-producing countries like Saudi Arabia, the United Arab Emirates and Kuwait have been making large investments in downstream projects in Asia, the primary engine of global demand growth for oil, in order to secure markets for their future energy production. Construction of new oil refineries and petrochemical complexes also ensures that these Asian countries continue relying on petroleum as the low-carbon energy transition plays out.

Discussions in Beijing were also expected to touch on China’s possible contributions to Saudi Arabia’s development, with China’s Belt and Road Initiative, which offers financing and construction of infrastructure and energy projects, well positioned to meet some of the Saudi Vision 2030’s needs. A memorandum of understanding announced focused on renewable energy cooperation between Saudi Arabia’s sovereign wealth fund and China.

Prince Mohammed’s tour reflects the kingdom’s pivot to Asia Saudi Arabia, China’s top oil supplier for several consecutive years before it was replaced by Russia from 2016 onwards, has long been an important oil partner for Beijing.

The latest deal with Norinco, together with an expected 170,000 bpd deal to supply Zhejiang Rongsheng, and another rumoured term deal with 400,000 bpd Hengli Petrochemical, expected to start commercial runs next quarter, put Aramco in good standing to see its exports to China increase significantly in years to come.

The Saudi giant has also benefited from US sanctions on Iran, which have prompted state Chinese refiners to request higher volumes of Saudi crude.

However, other crude oil suppliers, such as neighboring Russia, which also boasts considerable oil reserves, may be better positioned than Saudi Arabia, says analysts, as long as Russia is able to offer more competitive oil prices.

"Prices will be the key to oil supplies to China," says a source at China National Petroleum Corp.

China imported 1.14 mbpd of Saudi crude in 2018, but that was second to the 1.44 mbpd imported from Russia, which has benefited from strong demand from smaller independent refiners.