Production of unconventionals and LNG is driving growth

Production of unconventionals and LNG is driving growth

PIPELINES are the most efficient and economical means of transporting oil and gas from where it is extracted to where it will be processed and consumed. Natural resources such as crude oil and natural gas are the raw material for energy consumption that modern society relies upon. They are usually found in remote places and have to be transported to refineries or processors and turned in fuels.

Pipelines are increasingly being used to transport oil and gas as it combines efficiency and safety. Increasing demand for energy in regions where production is limited necessitates the need for safe and economic transportation from producers to consumers through pipelines. This supports the growth of the pipelines market, particularly in the Asia Pacific and Africa regions.

Visiongain has assessed that the value of the global oil and gas pipelines market in 2014 will reach $55.01 billion, while the new pipelines length to be added during that year will be 10,812 km.

ONSHORE PIPELINE CONSTRUCTION DEMAND

Meanwhile, as per the World Onshore Pipelines Market Forecast 2013-2017 from Douglas-Westwood, global expenditure is expected to reach $216 billion over the next five years, increasing by 12 per cent compared to the previous five year period with over 270 thousand km of pipelines expected to be installed. Major investment will be in pipe construction services (47 per cent) and line pipe (27 per cent).

“Over the past decade, continual increase in energy demand coupled with strong development in the production of unconventionals and LNG has set solid grounds for growth in the onshore pipeline sector. The next five years will see the realisation of a considerable number of ambitious inter-regional project, the report says.

KEY TRENDS

• Increasing gasification is shaping the long term demand profile for pipes. With an anticipated 35 per cent increase in global energy demand over the next twenty years, the role of natural gas is expected to account for 26 per cent of total energy consumption by 2030. This growing demand is also driving an increase in larger diameter pipelines.

• Investment in new infrastructure to support LNG and unconventional gas developments will be a major factor shaping future demand for pipelines. Outside the major oil province of the Middle East, gas-related lines accounted for 67 per cent of km installed over the past five years with this figure expected to increase over the 2013-2017 period.

• Increased investment in shale gas and oil will drive additional requirements for midstream line pipes in the US and surging Asian energy demand is changing traditional supply flows. Asia will overtake North America as the largest market for onshore pipelines as the region looks to increase imports of oil and gas from neighbouring regions.

• Rapid demand growth in Asia is also providing new markets for Russian oil and gas and with traditional importers in the west expected to curb their energy demand, major new interregional projects may be realised during the forecast period, such as the pipeline planned to connect Russia to South Korea.

PIPELINE LEAK DETECTION MARKET FORECAST

Increasing demand for fuel worldwide has been driving expansion in the oil and gas pipeline network across the globe. However, such rapid expansion in pipeline network also poses huge threats as the risk of pipeline leakage increases significantly.

As oil and gas pipelines are loaded with hazardous material, a single leak can transform into a potential disaster. Leakage from pipelines can result in major accidents, as has been observed in several incidences in the past.

Pipeline material failure and corrosion have been the major causes of leakage in oil and gas pipelines. Pipeline leakages cause significant losses for the company, including monetary and in the form of lost goodwill. Often, negligent companies are highly penalised for the severe damages caused by oil spills or gas leakage. Besides losses to the company, incidences of pipeline leakage cause adverse damage to the environment.

With growing number of oil and gas exploration activities globally as well as increasing environmental concerns, the demand for oil & gas pipeline leak detection systems is expected to surge during the forecast period.

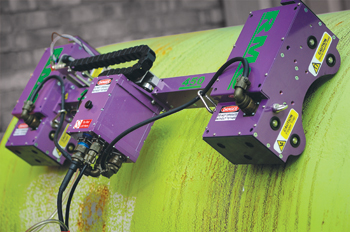

Pipeline leak detection system comprises various components, often provided as a turn-key solution by majority of players, which are integrated with a monitoring system to provide efficient and effective leak detection.

According to Global Oil and Gas Pipeline Leak Detection Market Forecast and Opportunities, 2019 report the global market for oil and gas pipeline leak detection systems is forecast to reach $2.5 billion through 2019.

The report discusses four key leak detection technologies that include flow monitoring, pressure monitoring, fiber optic sensors and infra-red leak detection, which is used in the detection of leakages in buried as well as un-buried hydrocarbon pipelines.

The demand for leak detection systems is expected to grow steadily across all regions globally, with Middle East and Africa (MEA) likely to exhibit the fastest growth during the forecast period.

The MEA region has been witnessing strong growth in the oil and gas sector in recent years, which has led to large-scale expansion of pipeline network in the region, particularly Middle East, thus benefitting the market for pipeline leak detection systems. The Americas captured the largest share in the global leak detection market, a trend likely to continue in the next five years.

Some of the leading players in the global leak detection market include Siemens, Pure Technologies, Schneider Electric, Honeywell International and Perma-Pipe among others. As the global pipeline industry proliferates, the demand for fast, accurate and efficient leak detection systems is expected to increase considerably in the years to come.