Sabic ... looking for investment opportunities

Sabic ... looking for investment opportunities

Saudi Aramco and Sabic have announced the selection of Yanbu, on the west coast of Saudi Arabia, as the site for the development of an integrated industrial complex to convert crude oil to chemicals (COTC)

Saudi Basic Industries Corp (Sabic), the world’s fourth-biggest petrochemicals company, is evaluating investment opportunities in Africa, China and the United States, underpinned by a positive global economic outlook, its chief executive says.

The petrochemical giant had reported a 5.4 per cent rise in third-quarter net profit citing higher average selling prices and increase in sale volumes. For the first three-quarters of the year, Sabic reported net profits of SR18.3 billion ($4.87 billion), as against SR14.73 billion in the same period in 2017 an increase of 24.2 per cent.

Gross profits reached SR44.95 billion as against SR37.44 billion in the same period last year an increase of 20.058 per cent. Yousef Al-Benyan, Sabic vice chairman and CEO, attributes the company’s strong performance this quarter to higher levels of reliability in operations and cost efficiency.

Benyan says he hoped the next quarter would be positive.

"The global economy is still growing at more than 2.9 per cent and this is an indicator for sustainable growth in the petrochemical industry," he says.

"In Saudi Arabia, the economy is expected to grow 2.2 per cent in 2019 and 2.4 per cent in 2019, so we have a positive outlook," he adds.

Analysts expected Sabic to make a net profit of around SR5.8 billion in the third quarter, according to the average of estimates of three analysts polled by Refinitiv.

To boost growth, Sabic is looking for investment opportunities in Africa, which is a promising market for maintaining sales growth, Benyan says.

He adds that the outlook for business in the United States, Asia and China remained positive despite some challenges from high energy prices.

|

Benyan ... no plans to tap debt maket |

The company’s results are closely tied to oil prices and global economic growth because its products - plastics, fertilisers and metals - are used extensively in construction, agriculture, industry and the manufacturing of consumer goods.

Meanwhile, Saudi national oil giant Aramco is in talks with the Public Investment Fund to buy its controlling stake in Sabic.

Asked about the deal, Benyan says Sabic had nothing to say at the moment about the deal as it is being discussed between a main shareholder, the Public Investment Fund, and Aramco as a future investor.

Saudi Energy Minister Khalid Al-Falih was quoted by Saudi state TV Al Ekhbariya as saying that he expected the details of the Sabic deal to be finalised within the first half of 2019.

Benyan says the company has a very strong balance sheet and tries to leverage it as much as possible, but does not have any plans to tap the debt market at this point.

"Our business transformation programme, initiated in 2015, continues to yield results as we drive toward realisation of our 2025 strategy," he says. Sabic is optimistic about the state of the global and Saudi economies, with the outlook for growth in each being strong.

Benyan acclaims the valuable contributions made by the employees in the company’s new phase of growth especially their efforts to increase the company’s rate of reliability.

"Our dedicated employees are our strongest asset," he says. "Thanks to their focused efforts, we have improved reliability to the point that we are able to absorb the higher feedstock and product costs we have been experiencing this year."

Benyan points to Sabic’s moving from fourth to third on Forbes’ annual ranking of the world’s largest chemical companies. Also, Moody’s has given Sabic an ‘A’ rating, due to its ‘strong global position’ in petrochemicals and fertilisers and access to competitively priced raw materials.

"We are humbled by these distinctions from Forbes and Moody’s see them as a major recognition of the progress we are making toward becoming the world’s preferred provider of chemicals by 2025," Benyan says. He also says Sabic would be establishing a new company to promote the development of small-to-medium-sized enterprises and local content creation in Saudi Arabia on which more details will be forthcoming.

|

Sabic’s R&D facilities develop 150 new products annually |

Operational profits for the first three quarters reached SR29.73 billion as against SR22.42 billion for the corresponding period the previous year, an increase of 32.604 per cent.

Sales for the first three quarters reached SR128.86 billion as compared to SR109.44 billion for the same period last year, an increase of 17.744 per cent.

Sales for the current quarter reached SR43.71 billion as compared to SR38.68 billion for the same quarter last year an increase of 13.004 per cent and SR43.28 billion in the previous quarter an increase of 0.993 per cent.

Meanwhile, Saudi Aramco and Sabic have announced the selection of Yanbu, on the west coast of Saudi Arabia, as the site for the development of an integrated industrial complex to convert crude oil to chemicals (COTC).

The announcement by Saudi Aramco and Sabic, the two largest industrial entities in the kingdom, reflects the high importance both companies place on making the kingdom a key hub for global chemicals production.

The complex will utilise an economically viable, innovative configuration to convert crude oil to chemicals. This process is unprecedented in the industry.

The COTC complex is expected to process 400,000 barrels per day of crude oil, which will produce

approximately 9 million tonnes of chemicals and base oils annually and is expected to start operations in 2025.

The complex is expected to create an estimated 30,000 direct and indirect jobs, further stimulating the kingdom’s economic diversification efforts. By 2030, the COTC complex is expected to have 1.5 per cent impact on the kingdom’s gross domestic product (GDP), with investments being shared equally by both companies.

Consistent with the kingdom’s Vision 2030 economic transformation programme, this project will support the creation of a world-leading downstream sector in Saudi Arabia, built on four key drivers: maximising value from the kingdom’s crude oil production via integration across the hydrocarbon chain; enabling the creation of conversion industries to produce semi-finished and finished goods to help diversify the economy; developing advanced technologies and innovation; and enabling sustainable development in alignment with the kingdom’s National Transformation Programme.

The announcement strengthens the alliance between the two largest Saudi global entities and solidifies the kingdom’s position as a global leader in chemicals by substantially increasing production and maximising value across the entire hydrocarbons chain.

Earlier this year, Saudi Aramco and Sabic awarded the project management and front-end engineering to Wood and KBR. The partners are working on finalising the selection of leading-edge technologies to complement their technologies.

Sabic has a wide range of businesses, which helps the company cater to the diverse needs of its consumer base and generate higher revenue.

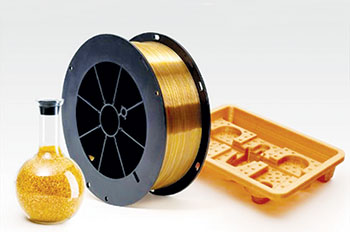

Headquartered in Riyadh, Saudi Arabia, Sabic manufactures on a global scale in the Americas, Europe, Middle East and Asia Pacific, making distinctly different kinds of products: chemicals, commodity and high performance plastics, agri-nutrients and metals. Its market leading operations, along with strong research and development (R&D) capabilities provide it a competitive advantage.

The company’s Technology and Innovation (T&I) division works with strategic business units to improve the manufacturing processes and develop new technologies. Its T&I facilities spread across the world focus on the development of new patents and certifications. As of December 2016, the company operated technology centres in China, India, the Netherlands, Saudi Arabia, and the US, according to a report by GlobalData.

Sabic develops new and highly innovative products through advanced application and process development. The company’s R&D facilities develop 150 new products annually. As of December 2016, the company had 12,191 global patents and was working on over 640 research projects, the report says.

More recently, Sabic has developed a dedicated, diverse global foam portfolio, applicable in almost all industrial applications - automotive, packaging, consumer and construction.

Sabic is adding to this portfolio with two new dedicated LDPE grades for the cross-linked foaming process – Sabic LDPE HP0722NDF and Sabic LDPE HP2022 NDF, which will be available globally.

Sabic’s new resins are specifically designed and beneficial for cross-linked foaming processes. Together with our partners we have created innovative recipe designs of our new grades with additional value due to improved foam quality and increased process efficiency," says Douwe van der Meer, engineer, market development and technical support.

These new solutions can enable better surface quality and smaller cell-size, with potentially improved mechanical properties due to their improved reactivity; we have conducted several customer trials in Asia which have indeed confirmed this," adds Kai Chek Kuan, engineer, market development and technical support.

The improved reactivity of Sabic LDPE HP0722NDF and Sabic LDPE HP2022NDF to cross-linking can result in more efficient processing, with shorter cycle times or faster line speeds, typically leading to a more competitive product and added value.

"We all face many global challenges due to an ever-growing population and increasingly limited resources. Foaming is key to help solving these challenges, by pushing industries to invest in solutions that are both sustainable and cost-efficient, with enhanced material properties." Says Frank de Vries, Sabic’s global foam and lightweight leader.

These two new LDPE grades for the cross-link foaming process are the latest examples from Sabic of such innovative solutions developed together with our customers and value chain partners," concludes Frank de Vries.

Sabic has a strong base of global supply chain which has enabled it to strengthen its operations. The company operates through a global network of 64 manufacturing plants in Argentina, Austria, Bahrain, Belgium, Brazil, Canada, China, Germany, India, Italy, Japan, Mexico, The Netherlands, Saudi Arabia, Singapore, South Korea, Spain, Thailand, the UK, and the US. It has approximately 20,000 delivery locations spanning 140 countries.

The company has more than 35,000 employees worldwide and operates in more than 50 countries, through a global network of 64 manufacturing plants and 19 technology centres.

Geographically, the company classifies its operations into six segments namely Middle East, Africa, Europe, Asia, America, and Others. In FY2016, the company generated 29 per cent of its total revenue from Asia, 26 per cent from Europe, 24 per cent from the Middle East, 9 per cent from America, 5 per cent from Africa, and 7 per cent from Others, GlobalData reported.

According to the report, Sabic could benefit from the increasing worldwide demand for fertilisers and capitalise on the opportunity to expand its business and revenue. According to International Fertiliser Industry Association (IFA)’s Fertiliser Outlook report 2016-2020, the global demand for fertilisers is expected to increase by 2.9 per cent per annum, reaching 186 million tonne by 2020. The fertiliser industry will invest close to $130 billion in more than 150 new production units, increasing global capacity by over 150 million tonnes products by 2020.