SABIC's Jubail building was inaugurated on November 23, 2023

SABIC's Jubail building was inaugurated on November 23, 2023

SABIC is planning to enter a new phase of evolution from which it can grow in a world where there are zero net carbon emissions and where new chemical products are made from sustainable feedstock

The year 2022 was of contrasting two halves for SABIC. The first half was a period of growth for the petrochemicals industry, while the second half witnessed a slowdown due to decreasing customer confidence and global events.

In both Q1 and Q2, the company reported increase in revenues of 3 per cent and 6 per cent respectively over previous quarters. However, it couldn’t maintain that momentum in the latter two quarters, when revenues fell 16 per cent and 8 per cent in Q3 and Q4 respectively over previous quarters.

The revenue increase in the first two quarters boosted the overall figures for 2022 and SABIC reported a revenue of SR198.47 billion ($ 52.92 billion), a 13 per cent increase over 2021.

Of the total, the share of petrochemicals and specialties was SR164.8 billion, 10 per cent more than over 2021. Some 47.9 million metric tonnes of petrochemicals and specialties were produced in 2022, 4 per cent more than 2021.

Net income for 2022 was, however, significantly lower than 2021. It was SR16.53 billion, a 28 per cent decrease compared to SR23.07 billion in 2021.

It is still a valued chemicals brand, rising to No 2 globally in 2021 and No 1 in the Middle East in 2023.

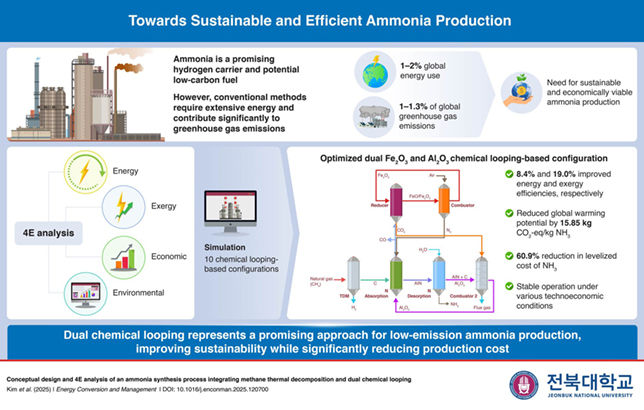

For the years ahead, Abdulrahman Al-Fageeh, SABIC’s CEO, says the company is planning to enter a new phase of evolution from which the company can grow sales volumes and profit margins in a world where there are zero net carbon emissions and where new chemical products are made from sustainable feedstock.

He outlines a six-point plan to make this new phase of growth a success, and involves strengthening its relationship with Aramco; delivering healthy returns for shareholders; enhancing environmental, social and governance (ESG) performance; forging collaborations through strategic partnerships; getting the right skillsets; and fostering a healthy entrepreneurial ecosystem that orchestrates of relevant actors in the energy and chemical industries.

A summary statement on its growth plan in the Annual Report for 2022 points to the company’s commitment to value creation while ensuring sustainability.

GROWTH TRAIL

SABIC had some notable achievements in 2022, and several key projects were brought to fruition.

It successfully started the Gulf Coast Growth Ventures facility in Texas, the US, with ExxonMobil, as its first major greenfield petrochemical investment in the Americas.

In Jubail, Saudi Arabia, SABIC started commercial operations of its new ethylene glycol plant.

And to underscore sustainable economic growth, it opened its new, energy efficient, carbon-neutral building in Jubail.

In October 2022, it started commercial operations at United’s third ethylene glycol (EG) plant. The plant has an annual production capacity of 700,000 metric tonnes of monoethylene glycol (MEG).

SABIC’s focus will continue to be petrochemicals, agri-nutrients, and specialties. Positioning itself as Aramco’s chemicals arm has allowed it to deliver on our agenda as the national chemicals champion and a leader in the global chemical industry.

After Aramco acquired a 70 per cent majority stake in SABIC in June 2020, both entities have strived to deliver on synergy benefits that generate maximum value.

SABIC’s share in the value creation and synergy is expected to amount to a recurring annual value of $1.5 billion to $1.8 billion, which SABIC expects to achieve by 2025.

SABIC is on track to reaching this goal. Since 2020, SABIC’s annual synergy value has averaged $1.1 billion, with $735 million realised in 2022.

The integration of Aramco and SABIC gathered steam with several key initiatives during the year. SABIC reached a major milestone in taking over the marketing and sales of several Aramco products, polyolefins, polyurethanes, performance monomers, ethylene oxide derivatives, and glycols – to better target downstream demand.

SABIC marketed chemicals and polymers from Aramco JVs, supplying customers in China, South East Asia, Middle East and Europe with an enhanced product offering. It also successfully added new products to its portfolio such as Polyurethanes.

Both companies have also made considerable progress on hydrocarbon optimisation between their refineries and steam crackers in Saudi Arabia.

GROWTH PROJECTS

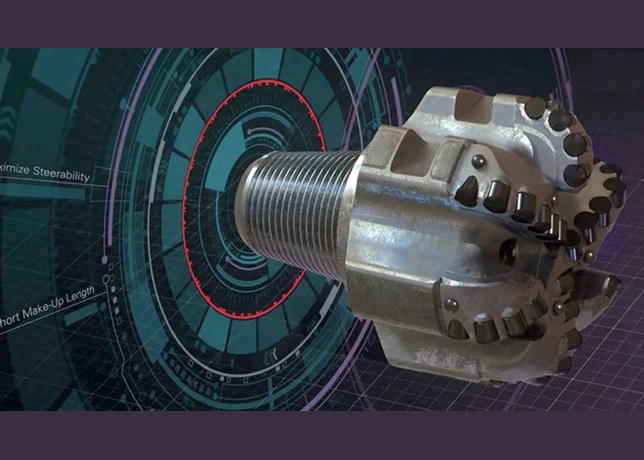

The rapidly evolving landscape requires SABIC to extract the maximum value from its experience, networks, and capital to innovate for the future.

To achieve this, SABIC aims to increase its collaborations and partnerships to develop projects and products that enable sustainability, create synergy, and reinforce its brand.

Important first steps were taken with two projects in China. The first included commencement of commercial operations in March this year at a polycarbonate production complex, developed by Sinopec SABIC Tianjin Petrochemical Company (SSTPC), as part of a joint venture between SABIC and Sinopec. The $1.7-billion project is expected to produce 260,000 metric tonnes.

Separately, SABIC signed an MoU with Aramco and Sinopec to conduct a feasibility study on developing an integrated petrochemical complex with existing refineries in Yanbu, Saudi Arabia.

SABIC intends to establish a 400,000 barrels per day (bpd) complex to convert oil and liquids into petrochemicals in Ras Al-Khair, Saudi Arabia; the complex is expected to convert 400,000 barrels of oil into chemicals daily.

And in Oman, a joint project development agreement was signed in December amongst SABIC, OQ, and Kuwait Petroleum International (KPI) to study the establishment of a jointly-owned petrochemical complex in the Special Economic Zone at Duqm (SEZAD). The complex will consist of a steam cracker, derivative units, and a natural gas liquid (NGL) extraction facility.

2023 OUTLOOK

Looking forward to 2023, uncertainties surrounding crude oil, natural gas, and financial markets make it difficult to predict how the petrochemicals industry will perform. Global container freight rates are expected to reduce, while liquid shipping rates will remain at elevated levels.

SABIC is expecting continued pressure on petrochemical markets with additional capacities that started in 2022.

For products such as PE, PP and MEG, demand in 2023 will not increase to such levels that operating rates and margins return to long-term average levels.

SABIC is bracing for the possible impacts of recessions in Europe and the US that will affect economies and could last, at least, until Q3 2023.

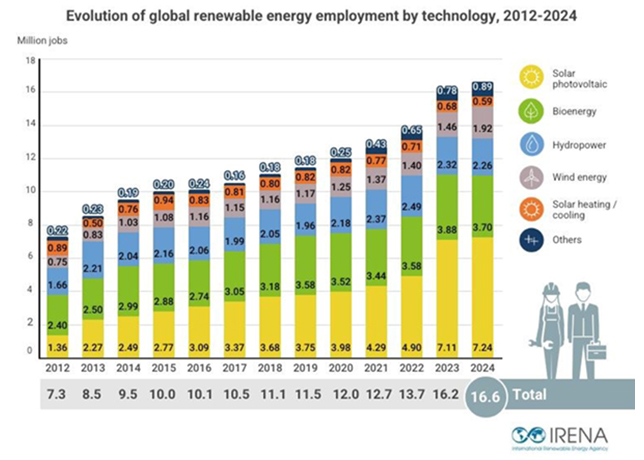

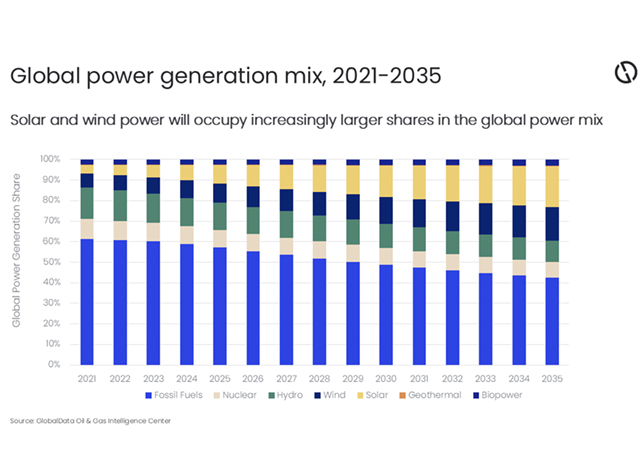

Moving forward, sustainability will continue to play an increasingly important role in the petrochemicals industry and with customers.

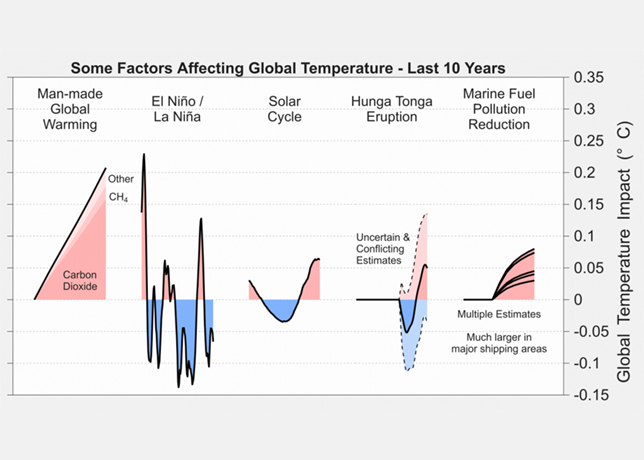

SABIC expects continued pressure on the industry to act on plastic waste, to utilise waste as a feedstock, and to take meaningful steps to reduce and eliminate the greenhouse gases released in our manufacturing processes.

There will also be increased focus to mitigate high energy and feedstock prices as we shift to a circular economy.

By Abdulaziz Khattak