PDO ... investing to sustain production

PDO ... investing to sustain production

The company is currently operating a range of commercial-scale EOR projects, including chemical EOR, miscible gas injection and thermal applications, which accounted for 10 per cent of the sultanate’s average oil production

Petroleum Development Oman (PDO), the nation’s largest oil and gas producer, plans to invest $20 billion until 2021 to sustain its oil and gas production over the long term, including by boosting the number of enhanced oil recovery (EOR) projects, the company says.

It is anticipated that by 2025, more than 23 per cent of PDO’s crude output will come from EOR projects, the firm says in its recently published annual Sustainability Report 2017.

PDO is currently operating a range of commercial-scale EOR projects, including chemical EOR, miscible gas injection and thermal applications, which accounted for 10 per cent of the sultanate’s average oil production of just above 582,000 barrels per day in 2017.

Oman halted years of oil production declines in 2008, subsequently reversing the trend and achieving modest output increases, with output now approximately 1 million barrels per day (mbpd). It also turned around its gas sector and more recently reached a production surplus.

The improved outlook in recent years has helped Oman to attract major international companies such as BP, Eni, Total and Indian Oil Corp. (IOC) to its energy sector. Its burgeoning popularity with international players stems from its relatively straightforward regulatory and fiscal environment, as well as its appealing recent upstream licensing rounds.

PDO produces the bulk of the oil and gas in Oman, the largest Arab oil producer that is not a member of Opec. The company is 60 per cent owned by the Omani government, with Royal Dutch Shell holding 34 per cent, Total 4 per cent and Partex 2 per cent.

According to the report, PDO last year operated 178 producing oil fields, 14 gas fields, 21 production stations, in excess of 10,000 active wells, and more than 18,500 kilometres of pipelines and flowlines.

|

Restucci ... increasing cost efficiency |

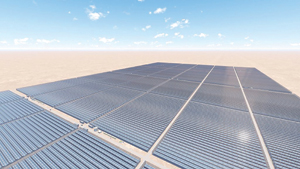

Oman’s hydrocarbon resources are relatively small compared to its Gulf Arab neighbours Saudi Arabia and the United Arab Emirates and contain heavier and harder-to-extract crudes that require EOR for extraction. Earlier this year, PDO in conjunction with US-based Glasspoint launched the 1 gigawatt Miraah solar scheme for the utilisation of EOR at the Amal heavy oil field in the south of the country. The project produces 6,000 tonnes per day of steam to displace natural gas for use in EOR.

PDO, in the report, says it showed good compliance with revised production targets arising from the Opec-led supply cut agreement, in which Oman is a participant.

The company’s average oil production in 2017 was 582,196 bpd, 14,000 bpd higher than the adjusted target. Condensate production meanwhile stood at 68,467 bpd, 8,740 bpd below target, because of the frequent closure of the Rabab field wells for flare control and a variable performance at the Kauther gas plant among other reasons.

PDO says it would start to play more of swing producer role in the sultanate in the future as additional capacity from the 1 billion cubic metre per day Khazzan gas scheme developed by BP come on stream. "Overall, we see a great opportunity to monetise surplus gas over the next five or more years, further supported by new exploration finds," PDO says.

Despite being committed to meeting the World Bank target of reducing flaring to zero well before a 2030 deadline, PDO’s flaring activities increased by 14 per cent in 2017, to 14.62 tonnes flared per 1,000 tonnes of oil and gas produced compared to 12.86 tonnes in 2016. This was mainly because equipment failure at some fields caused nonroutine flaring activities, says PDO, adding that it will increase focus on addressing these issues.

PDO’s capital expenditure last year was $5.8 billion, while current capex for 2018 is set at $4.1 billion, down in part on improved efficiencies.

PDO says it is pressing ahead with its Enhanced Oil Recovery (EOR) programme notwithstanding ongoing fiscal challenges posed by the constrained economic environment.

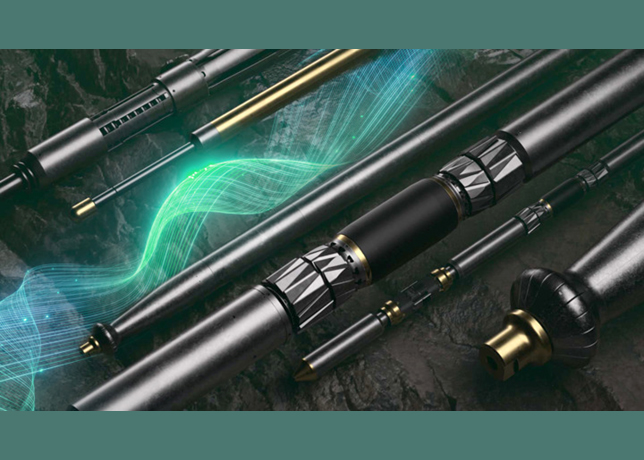

At the same time, PDO is also investigating a number of ‘novel EOR technologies’ for their efficacy in unlocking difficult hydrocarbon resources. "This is being done through a series of dedicated laboratory and field testing programmes," the company states. Notable among PDO’s chemical EOR initiatives in the Marmul Polymer project, Phase 1 of which came into operation more than seven years ago, delivering around 13.7 million barrels of oil since then.

|

PDO’s Fahud field |

The second phase, centering on the injection of polymer into 19 additional wells starting in 2015, has delivered 840,000 barrels of oil to date. Both phases have contributed an average production of 5,755 barrels per day (bpd) of oil in 2017. Last year, PDO took a Final Investment Decision to implement Phase 3 of the project, entailing the infill drilling of existing wells in the Marmul Al Khlata reservoir, along with water-flood and polymer rotation.

Around 80 million barrels of incremental oil is proposed to be developed during this phase, with first oil anticipated by Q1 2023, according to the Sustainability Report. Miscible sour gas injection - another type of EOR - has boosted oil recovery from PDO’s Birba field by 22 per cent while yielding an additional 50 million barrels of crude since the project was launched around 23 years ago.

The recovery rate is projected to climb to 45 per cent as further infill drilling and additional gas injection activities are undertaken.

At Harweel 2AB, miscible gas injection that began in April 2014 was ramped up to full capacity a year later, with the potential to boost recovery from the field by about 45 per cent. Likewise, gas injection in the Sakhiya field, undertaken as part of the Sak mini-flood project, is contributing to positive reservoir pressure and slowing depletion rates. In Qarn Alam, thermal gas-oil-gravity-drainage (T-GOGD) - a thermal based EOR initiative under way since 2011 - is helping enhance hydrocarbon production from the reservoir. Last year alone, 6.8 million barrels of oil was produced following the injection of 3.3 million tonnes of steam into the Shuaiba oil-bearing formation. Injection rates reached peak levels of 15,000 tonnes per day.

The Amal steam project - a signature EOR initiative of PDO - achieved an average output of 15,716 bpd in 2017. "There was a continued strong steam injection performance with 2017 representing the highest annual average injection rate of around 7,700 tonnes per day," according to the report.

Meanwhile, Oman Oil Company (OOC), the Omani government’s energy investment arm, has confirmed that it is looking to divest part of its stake in Block 61, which hosts the prolific Khazzan and Ghazeer gas developments in the oilfield heartland of the sultanate.

OOC chief executive officer Eng Isam Saud al Zadjali says the Block 61 divestment plan is part of a slew of initiatives for the privatisation of some of the Group’s diverse subsidiaries. Al Zadjali says the group is in the market for a buyer for 10 per cent of its 40 per cent stake in Block 61 - a divestment exercise that is ‘ongoing’, he noted. Oman Oil Company Exploration and Production (OOCEP), the wholly owned upstream arm of Oman Oil Company, holds the 40 per cent stake in Block 61.

Energy major BP owns the balance 60 per cent and is also the operator of the Block, which came on stream last September with a current output of 1 billion cubic feet of natural gas per day.

The parent company, the CEO says, is also doing the groundwork for the privatisation of Abraj Energy Services, a leading oilfield services firm wholly owned by OOC. "Next year we have one or two more companies that will be studied carefully for privatisation," he further states.

OOC is also in the market for finance required to fund its existing operations as well as for future projects, notably those that may materialise from its newly forged partnership with energy super-major Shell, according to the CEO.

"We are always in the market for new financing because we never stop coming up with new ideas," says Al Zadjali.

"The Revolving Credit Facility (RCF) that we have will expire in less than two years and we need to go to the market to renew this facility under new terms and conditions. Ultimately, we have to think about new projects.

"The partnership we may have with Shell will require new financing. So we are excited about concluding existing deals and entering into new projects, and as we are an investment company, obviously everyday financing is the name of the game."

The CEO credits Oman’s Oil Company’s ongoing success in securing funding for its various projects to the sound fundamentals of the group, as well as the strong credentials of the Omani government. "We are honoured to have successfully completed the financing for multiple projects, namely Salalah Ammonia, Salalah LPG, financing of the pre-export facility of OOCEP, and so on. The completion of the financing, at a level that is satisfactory to us, is a testament to the hard work that the company has put in, and also of the robustness of the Omani economy. It is facts on the ground that lenders and international financial houses take into account when concluding a deal that is both satisfactory to them and to us.

"Their decisions also rely heavily on the strength of the Omani economy and the effectiveness of the Omani government."

Al Zadjali also reaffirms the group’s strategy to remain a ‘minority stakeholder’ on the upstream side of its business. "That will always be the policy of the company. We bring in and partner with reputable international companies that have the experience and technical know-how and we will partner with them on a minority basis.

"This minority working interest is so critical to the success of OOC, going forward," he stresses. "It’s not a secret that the upstream segment presents a substantial size of Oman Oil’s business, and stronger that foundation the better it is for Oman Oil and the country," he adds.

Most of the main PDO oilfields are over 48 years old and have been declining for several years. As a result, PDO has been spending heavily on diverse EOR systems. Gas fields and processing plants are operated by PDO on behalf of the government.

PDO in January 2012 became a member of the International Technology Facilitator (ITF), a non-profit agency aimed at increasing E&P co-operation. PDO thus joined NOCs like Saudi Aramco and the Kuwait Oil Co. (KOC) which help JVs of NOCs and IOCs to share R&D costs and man-power. PDO used ITF to further R&D into EOR techniques.

PDO in 2012 launched a 10-year plan to invest over $11 billion in 16 projects to develop over 1bn barrels of crude oil, part of PDO’s strategy to 2022. While running after any new EOR technology, PDO has since mid-2014 adopted one of the toughest cost-cutting methods to cope with falling oil prices. On January 3, 2016, PDO’s managing director Raoul Restucci was quoted as saying the MOG-controlled firm focused hard on increasing cost-efficiency and was striving to keep raising oil and gas production.