South Korea losing share to rival Asian yards for FPSO/FLNG Newbuilds

South Korea losing share to rival Asian yards for FPSO/FLNG Newbuilds

With higher volumes of tendering activity to be sustained, HHI will be hoping that improved cost efficiencies and reduced competition from the merger will put them in pole position to challenge for the $30 billion of Newbuild FPSO/FLNG projects

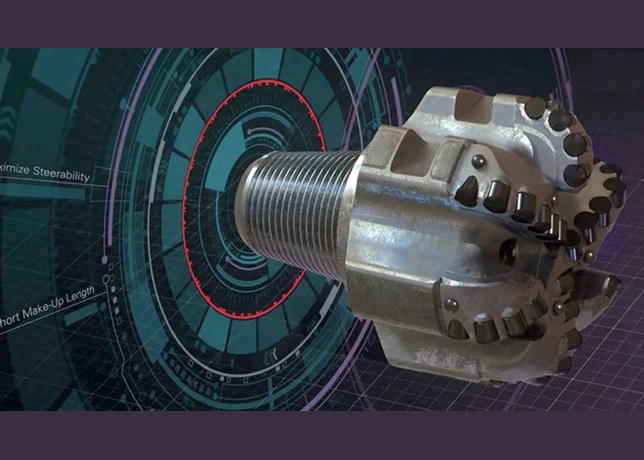

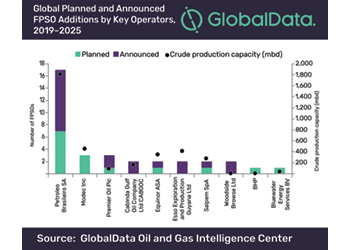

The offshore market is set for a bumper year with 83 greenfield FIDs expected, totalling $115 billion in infrastructure, equipment and associated drilling services. This includes $19.2 billion on FPSO/FLNG awards – of which $5.5 billion are lucrative newbuild FPSO opportunities.

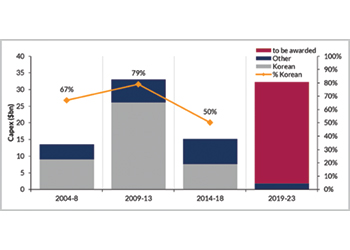

Historically, the 'Big 3' South Korean yards – Samsung Heavy Industries (SHI), Hyundai Heavy Industries (HHI) and Daewoo Shipbuilding & Marine Engineering (DSME) have been the undisputed leaders in the Newbuild FPSO/FLNG space accounting for 55 per cent of orders and 73 per cent of the spend over 2004-2013.

However, changing procurement behaviours of E&Ps coupled with the improving EPC capabilities of rival yards in Singapore and China has seen this fall to 38 per cent and 50 per cent over the past five years. Recent high profile FPSO tenders such as Equinor’s Johan Castberg, Energean’s Karish and BP’s Tortue were awarded to non-Korean yards. This was typically via engineering specialists such as BW or TechnipFMC, a clear departure from the integrated EPC/Yard model of the 'Big 3'.

One reaction to this has been the potential acquisition of DSME by local rival HHI that has the potential to change the competitive nature of the contracting landscape. This acquisition is expected to be completed by Q4 2019, with HHI purchasing Korea Development Bank’s (KDB) 55.7 per cent stake in DSME for approximately $1.78 billion. The rationale of the merger was justified in a statement by KDB chairman, Lee Dong Gull: 'In order to fundamentally enhance the competitiveness of the industry, it is crucial to eliminate the inefficiency caused by overlapping investment under the current ‘Big Three’ structure'. With higher volumes of tendering activity to be sustained, HHI will be hoping that improved cost efficiencies and reduced competition from the merger will put them in pole position to challenge for the $30 billion of Newbuild FPSO/FLNG projects expected to be awarded over the next five years. However, approval from antitrust regulators in multiple countries especially from Asian rivals remains a significant hurdle.