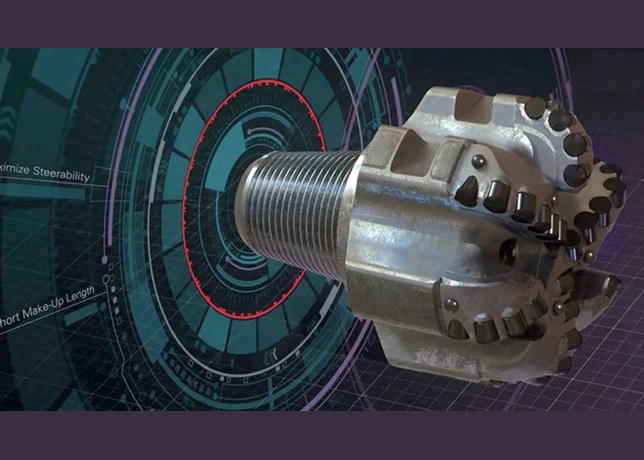

Expro¸ energy services provider, has entered into a definitive agreement to acquire Coretrax, a technology leader in well integrity and production optimisation solutions, from an investment group led by Buckthorn Partners.

The acquisition of Coretrax will enable Expro to expand its portfolio of cost-effective, technology-enabled well construction and well integrity solutions, particularly across the North and Latin American, Europe and sub-Saharan Africa, and the Middle East and North Africa.

Building on Coretrax’s successful 15-year history, the acquisition will accelerate the availability of the company’s innovative tools by leveraging Expro’s global operating footprint.

The proposed transaction involves a total consideration of $210 million, including $75 million in cash and 6.75 million new Expro common shares. The cash component may be increased at Expro's selection.

The equity consideration will be unitised based on Expro's volume weighted average price. The total consideration is 4.7x Coretrax's estimated 2024 Adjusted EBITDA, excluding possible cost and revenue synergies. Expro aims to achieve up to $10 million in annual run-rate cost synergies in the first 18 months.

Michael Jordan, the CEO, said: "We are thrilled to announce our proposed acquisition of Coretrax and look forward to welcoming JohnFraser and his teammates to the Expro family.

John Fraser, CEO at Coretrax, commented, "The synergies between our respective technology portfolios will enable us to grow our market share while significantly increasing our capabilities to tackle the most complex well challenges. We are proud of the innovation-led approach, strong customer base and performance history that we developed over the last 15 years, and we look forward to joining forces with Expro to create greater value for our customers globally."