Sheikh Tahnoon bin Zayed Al Nahyan with President Donald Trump

Sheikh Tahnoon bin Zayed Al Nahyan with President Donald Trump

The UAE has announced a landmark $1.4 trillion investment framework in the US over the next decade, with a major emphasis on energy infrastructure and natural gas.

The investment, unveiled after a high-profile meeting between Sheikh Tahnoon bin Zayed, Deputy Ruler of Abu Dhabi and National Security Adviser, and US President Donald Trump, will significantly expand the UAE’s presence in key US industries, including artificial intelligence (AI), semiconductors, manufacturing, and energy.

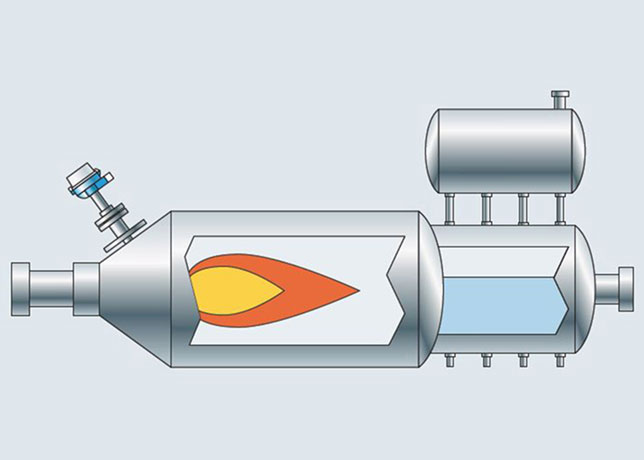

A substantial portion of the UAE’s new investment strategy will focus on the US energy sector, particularly natural gas and infrastructure.

Earlier in March, UAE energy giant ADNOC’s international investment arm, XRG, announced plans for major investments in US gas, targeting projects across the supply chain, including exploration and production, distribution and exports.

Speaking at the CERAWeek energy conference in Houston, Sultan Al Jaber, ADNOC CEO, confirmed XRG's commitment to large-scale investments in American natural gas. "Over the next few months and foreseeable future, you will see very large and significant investment by XRG in the US," he said.

In line with this strategy, XRG has already committed capital to the NextDecade LNG export facility in Texas, with additional investments planned in US gas fields, chemicals, energy infrastructure, and low-carbon solutions.

Reports also indicate ADNOC is actively looking to acquire producing natural gas fields in the US, a move that would deepen its foothold in the market while securing feedstock for its expanding chemicals and LNG operations.

Additionally, Abu Dhabi’s state-owned investment fund ADQ and its US partner Energy Capital Partners have launched a $25 billion initiative to invest in energy infrastructure and data centers across the country.

The UAE has long been a key player in the global energy market, and this investment underscores its intent to solidify its presence in the US while supporting its own economic diversification goals.

The country has been aggressively expanding into AI, semiconductors, and advanced manufacturing, sectors also included in the broader $1.4 trillion commitment.

Beyond energy, the UAE is investing heavily in AI infrastructure and critical industries. Abu Dhabi-based MGX, alongside BlackRock, Microsoft, and Global Infrastructure Partners (GIP), has joined forces with NVIDIA and xAI to establish the AI Infrastructure Partnership (AIP), aiming to mobilise up to $100 billion for next-generation data centers and energy-efficient AI facilities.

Additionally, Emirates Global Aluminum has committed to building the first new aluminum smelter in the US in 35 years, nearly doubling domestic aluminum production.

ADQ and Orion Resource Partners have also launched a $1.2 billion mining partnership focused on securing critical minerals essential for modern industries.