Critical minerals, alongside water and power, will determine where industrial value chains can expand

Critical minerals, alongside water and power, will determine where industrial value chains can expand

While the energy-minerals-water nexus, and the vulnerabilities therein, define global industrial strategy, understanding dependencies reveal sustainable industrial hubs, Karin Goettlich and Eva-Maria Pusch tell OGN

Energy systems, critical minerals, and water resources — the three essential foundations of industrial development — are converging in ways that will reshape global competitiveness and the geography of industrial growth.

The future of energy will not be defined by a single transition, but by diversification.

The next decade will be determined by how intelligently nations and industries manage these interdependencies.

Energy diversification requires moving beyond linear thinking and recognising that the resilience of one system depends on the stability of all three.

FROM TRANSITION TO DIVERSIFICATION

For much of the past decade, the phrase energy transition has dominated discussions in boardrooms and policy forums.

It evokes a linear shift from fossil fuels to renewables. In reality, the global system is evolving in parallel: Oil, gas, renewables, hydrogen, and new fuels will coexist; each influenced by local geography, water availability, mineral access, and industrial demand.

Energy diversification is, therefore, less about replacement and more about integration. It is about aligning resource availability with policy and technology to ensure flexibility and long-term resilience.

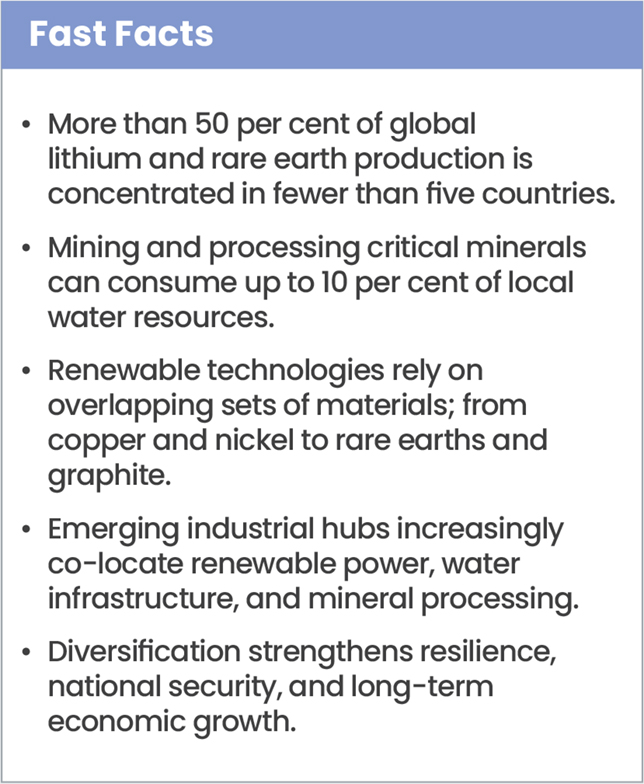

Critical minerals such as lithium, nickel, and rare earths, alongside reliable water and power, will determine where industrial value chains can expand.

Mining requires vast energy and water; desalination demands power; and renewable technologies depend on mineral inputs. None can operate in isolation.

The interdependence of these systems is creating new industrial logic. Nations that invest in diversification rather than substitution are finding themselves better positioned to weather volatility, whether driven by commodity prices, trade disruptions, or shifting climate conditions.

THE TRIPLE NEXUS: ENERGY, MINERALS & WATER

The energy-minerals-water nexus is rapidly becoming one of the defining dimensions of global industrial strategy.

|

Concentrated mineral production, water scarcity, and fragmented governance have introduced new vulnerabilities into energy supply chains.

Understanding these dependencies reveals where sustainable industrial hubs can emerge — locations capable of balancing renewable generation, water management, and mineral access.

Future hubs will increasingly co-locate infrastructure: Desalination, clean energy, mineral processing, and manufacturing facilities working in tandem to reduce logistics, emissions, and costs.

When energy, water, and minerals are planned together, supply resilience increases, and industrial strategy becomes less exposed to single points of failure.

For example, the Middle East is exploring synergies between solar energy, desalinated water, and critical mineral processing; Latin America is integrating renewable capacity into its copper and lithium corridors; and Africa is positioning its abundant solar and wind resources alongside its mineral wealth to attract investment in refining and downstream manufacturing.

This pattern signals a broader shift: Industrial hubs are no longer defined solely by proximity to fossil reserves or ports, but by resource complementarity — the ability to connect multiple resource systems within a single region.

CLIMATE, WATER & SECURITY INTERTWINED

Water scarcity and climate risk now sit at the heart of industrial planning.

Rising global temperatures and more frequent droughts threaten power generation, cooling systems, and mining operations.

At the same time, new water-intensive industries such as green hydrogen and semiconductor manufacturing are expanding rapidly.

Balancing these competing demands requires sophisticated management of water-energy trade-offs.

Regions investing in desalination powered by renewables or waste heat recovery are gaining an edge in energy-intensive sectors.

Meanwhile, countries with weak water infrastructure face growing constraints on their industrial ambitions.

Water security is also becoming a geopolitical variable. Shared river basins, cross-border aquifers, and changing rainfall patterns influence both regional stability and foreign investment decisions.

Integrating water strategy into national energy and mining frameworks is now a prerequisite for sustainable growth, not a technical afterthought.

MAPPING TOMORROW’S INDUSTRIAL HUBS

Across the world, a new geography of opportunity is taking shape.

In the Gulf region, integrated strategies are combining desalination, hydrogen production, and mining to create circular economies.

In Brazil, biofuels, renewable generation, and critical mineral extraction are being linked through new logistics corridors that reduce dependency on imported fuels.

In Namibia, Chile, and Indonesia, governments are coupling renewable capacity with mineral processing, leveraging abundant solar or geothermal resources to anchor domestic manufacturing.

These regions are not merely developing renewable capacity. They are building systems where resources and industries reinforce one another.

This approach reduces transport needs, anchors investment locally, and enables cleaner, more resilient industrial growth.

The industrial map of the 20th century was drawn around oilfields and shipping lanes. The map of the 21st will be drawn around resource intersections — places where water, energy, and minerals can be produced, processed, and exchanged in sustainable balance.

CLOSING THE INTELLIGENCE GAP

Despite these developments, planning still lags behind complexity.

Most data and policy frameworks treat energy, minerals, and water as separate domains.

This fragmentation increases risk and limits foresight.

A new generation of integrated intelligence systems is beginning to fill that gap.

By linking market, infrastructure, and geospatial data, these approaches reveal where investment in one system can unlock value in another.

They also help policymakers visualise vulnerabilities: drought risks to hydropower, mineral bottlenecks affecting renewable deployment, or overlapping demand between mining and agriculture.

Such tools are transforming strategy from reactive to anticipatory. They enable scenario planning, early warning for supply shocks, and cross-sector dialogue between ministries and private stakeholders.

For investors, this means understanding not only what resources exist, but how they interact — where regulatory, environmental, and logistical conditions align to enable stable industrial growth.

In this sense, intelligence becomes infrastructure. Foresight replaces speculation. And data becomes a bridge between ambition and execution.

THE ROAD AHEAD

As nations seek to secure growth while addressing climate and resource constraints, energy diversification will replace transition as the guiding principle of strategy.

Regions that successfully align critical minerals, water security, and renewable potential will emerge as the industrial hubs of tomorrow.

Achieving this will require unprecedented collaboration across sectors and borders.

Governments must integrate industrial, environmental, and trade policies.

Companies must view supply chains as ecosystems rather than pipelines.

And investors must balance short-term returns with long-term system resilience.

The most successful industrial ecosystems of the future will not only produce energy but orchestrate it — connecting power generation, water management, and mineral value chains into cohesive, adaptive systems.

In a world of mounting complexity, the advantage will lie with those who think in systems, not sectors.

Understanding where and how energy, minerals, and water intersect is no longer optional; it is the foundation for sustainable, secure, and resilient industrial development.

• Karin Göttlich is the Founder and CEO of GES Green Earth Solutions, based in Vienna. Her work focuses on integrating strategic intelligence across energy, minerals, and water systems to support sustainable industrial development.

Eva-Maria Pusch is Managing Partner of 360 Jet Fuel, an international advisory and technology firm accelerating the renewable and circular fuel ecosystem. She focuses on foresight, diversification, and the intersection of sustainability and strategy.

Karin and Eva have joined forces as co-founders of 360ValUSE, a strategic advisory foundation and scalable venture hub driving the future of energy transition, water, critical minerals, and regeneration.

360ValUSE transforms intelligence into an investment-ready, scalable vehicle. They bridge the gap between strategic insight and actionable venture building, creating lasting value across the transition economy.