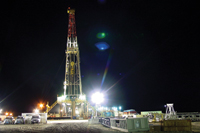

Naimi ... dispelling any fears of supply problems

Naimi ... dispelling any fears of supply problems

SAUDI Arabian oil minister Ali Naimi says the kingdom can raise its crude oil production by 2 million barrels per day (mbpd) almost immediately and describes as “disturbing” Iranian threats that have roiled oil markets.

Iran’s Opec governor, Ali Khatibi, warned Arab oil producers against colluding with the West by agreeing to offset any gap in supply should Iranian crude oil be subjected to an embargo.

Naimi’s comments were the first reaction by a Saudi government official to recent rhetoric from Tehran, where some military commanders and politicians have threatened to shut the Strait of Hormuz oil route from the Gulf.

“Let me put it this way. I don’t think all these pronouncements are helpful to the international oil market or to the price of oil. It’s really disturbing,” Naimi says.

“I believe we can easily get to 11.4, 11.8 mbpd almost immediately, in a few days because all we need is to turn valves,” he says when asked how soon Saudi Arabia could turn up the taps in the event of a supply disruption. “To get to the next 700,000 or so, we probably need about 90 days.”

Saudi Arabia, the world’s leading oil exporter, has total oil production capacity of 12.5 mbpd. Its December output was 9.8 mbpd.

Naimi was responding to questions about fears of a supply gap should Iranian oil exports of 2.2 mbpd be interrupted as a result of tighter sanctions and a threatened EU oil embargo.

He stresses that Saudi Arabia maintained spare production capacity to meet any emergency shortage in supplies and to satisfy demand from its customers.

“This spare capacity is to respond to emergencies worldwide. To respond to a customer demand. That is really the focus. Our focus is not who drops out of production but who wants more,” Naimi says, referring to Saudi Arabia’s decision to raise output to make up for the loss of output in the US Gulf as a result of Hurricane Katrina in 2005.

The kingdom, the biggest crude oil exporter to China, was prepared to meet requests for additional supplies from China and other buyers, Naimi says.

“We know China’s overall demand fluctuates over the course of the year by between 400,000 and 500,000 bpd. But like prudent customers, they have diversified their supplies,” he says.

“So if we were asked to provide an additional 200,000 or 300,000 bpd, that’s not a big deal because you know we have the capacity to produce 12.5 mbpd,” Naimi says, adding that Saudi Arabia has been producing between 9.4 mbpd and 9.8 mbpd.

The US, which in December imposed sanctions against Iran’s Central Bank making it more difficult for Opec’s second biggest producer to receive payment for its crude oil exports, has urged Asian oil consumers China, Japan and South Korea to lessen their reliance on Iranian oil. Saudi Aramco and China’s biggest refiner Sinopec signed an agreement to build a 400,000 bpd oil refinery in Yanbu on the Red Sea Coast.

The signing ceremony coincided with a visit to Riyadh by Chinese Premier Wen Jiabao, who reportedly raised the issue of energy security with Saudi King Abdullah and other senior officials.

Asked whether Japanese and South Korean fears about the potential loss of Iranian oil were justified and whether Saudi Arabia would be able to meet any supply gap from Iran, Naimi replies: “Absolutely. As long as they are customers, we will honour their requests.”

Oil prices have been rattled by threats from some Iranian officials that they would block oil traffic through the Strait of Hormuz should their oil exports be targeted by sanctions.

Naimi says he did not think any closure of the strait would last long and CNN quoted him as saying that, while half of total Saudi oil exports are shipped through the Gulf waterway, Saudi Arabia had other alternatives.

“I personally do not believe that the strait, if it were shut, will be shut for any length of time. The world cannot stand for that,” Naimi says.

Naimi also he would like to see oil prices stabilised at around $100/b, explaining that he was referring to an average of Nymex crude, Brent and the Opec basket.

“Our wish and hope is that we can stabilise this oil price and keep it at a level around $100...for the average of the crudes worldwide. If we were able as producers and consumers to average $100, I think the world economy would be in better shape,” Naimi says.

With exports to the US already under an existing decades-old embargo, Iran is now facing the prospect of losing market share in Asia to rival producers, namely Opec kingpin Saudi Arabia with which its relations have been testy in the past year. Khatibi advises Arab oil producers to exercise wisdom, adding that a Western oil embargo would come only if the other Gulf producers provided assurances that they would raise their output.

|

|

Aramco ... enough spare oil |

“If our southern neighbours cooperate with adventurist countries by replacing Iran’s oil with their own, these countries will be considered accomplices in subsequent events,” Khatibi says in the strongest warning so far by Tehran to fellow Opec oil producers in the region. “The consequences of such action cannot be predicted. Therefore the southern Arab neighbours should adopt reasonable policies and not cooperate with the adventurists,” Khatibi says, referring to the Western powers.

“If these countries make a mistake and give a green light, this will be a historic green light. Then they will wish that things return to the way they are now. But it won’t be easy,” he adds.

The region’s main Arab producers are Saudi Arabia, Kuwait, the UAE, Qatar and Iraq, all Opec members, along with non-Opec Oman. Khatibi made no specific mention of Saudi Arabia but another Iranian oil official says the kingdom would not be able to substitute Iranian oil.

“Even now, there is a shortage of around 5 million barrels of crude oil on global markets and producers have not covered this demand,” Mohsen Qamsari, NIOC’s director for international affairs, was quoted as saying by student news agency ISNA. He referred to a gap between current supply of around 85 mbpd and demand of 90 mbpd.

“The second thing is that the only Saudi Arabian oil that can replace Iran’s in the global markets is ‘medium,’ and production of that grade is only around 1.2 mbpd,” Qamsari says.

“On the other side, Saudi Arabia has regular customers for this amount and has committed to its sale. Therefore, Saudi Arabia has no surplus oil that can replace Iran’s oil in the global markets,” he adds.

He put Iran’s oil exports at around 2.3 mbpd.

Washington is pressing for a new set of sanctions that would cut Iran’s oil exports to its global customers.

Simultaneously, the EU is expected to announce an embargo on Iranian crude oil exports as part of growing international pressure on Iran over its nuclear programme. “Up until this moment, no company has left Iran and there has been no problem with oil sales. But we have considered preparations in case of such events,” Qamsari says.

Senior Iranian military officials and some politicians have stated in recent weeks that should Iran be prevented from exporting oil, it would consider blocking oil traffic through the strategic Strait of Hormuz.

Khatibi referred to the security of tanker traffic through the strait, saying the entire region would suffer the consequences of any disruption to traffic through the Gulf.

“The Strait of Hormuz is part of the region and if the regional countries unanimously say ‘no’ to things that are detrimental to the region’s security, certainly nothing will happen,” he says.

Washington, which has a permanent naval base in Bahrain policing the Gulf, has issued a stern warning to Tehran over the threat to oil traffic through the strait in a rare communication with Iranian officials.

The New York Times reported that the US administration had sent a private warning to Iran’s supreme leader, Ayatollah Ali Khamenei, that an Iranian attempt to close the Strait of Hormuz would cross a “red line” that would lead to a military response.

Iran’s foreign ministry spokesman Ramin Mehmanparast confirmed receipt of the letter, sent via the Swiss Embassy in Tehran and Iraqi President Jalal Talabani.

“This letter is being examined and if necessary, we will respond,” he says.