Sinopec ... partner in joint exploration venture with Aramco

Sinopec ... partner in joint exploration venture with Aramco

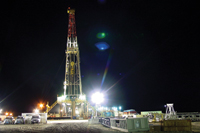

SINO Saudi Gas Ltd plans to drill again in Saudi Arabia’s Empty Quarter in September but gas prices are still too low for companies exploring there, the chief executive of Saudi Aramco says.

The joint venture between China’s Sinopec and state-run Aramco has been hunting for natural gas for years, but what little they have found has not been exploited due largely to industrial gas prices fixed far below international market prices.

Nevertheless, the two partners have decided to press on with a second phase of exploration and will start drilling new wells, known as “spudding”, in the desert in southeast Saudi Arabia in the second half of the year.

“We have Sino Saudi gas doing some studies and will be spudding their next well in September, so there will be one more well to drill in September,” Khalid Al Falih says. In the second phase of exploration, the joint venture which is 80-per cent owned by Sinopec and 20 per cent by Aramco, will only drill one well, an industry source says.

Saudi Arabia, keeps its vast oil reserves off-limits to foreign companies, invited investors in 2003-2004 to find and produce gas in the Empty Quarter.

But the gas price terms agreed were so low that companies needed to find condensate – a form of light oil that can be sold at international market prices – to cover the costs of development.

“One challenge we have is the pricing of gas is very low in Saudi Arabia and does not make unconventional gas or tight gas in the Empty Quarter economic,” Al Falih told reporters after signing a $10-billion refinery deal with Sinopec in Yanbu. “This is something that we are hoping that will be addressed by the government in due course.”

The government set transfer price of natural gas in the kingdom is 75 cents per million British Thermal Units (mmBtu), a fraction of the price paid for gas in most countries. Saudi Aramco, the world’s largest oil exporter, is now focusing on boosting gas production to help meet rapidly rising Saudi fuel demand.

“In terms of gas, we have been growing our gas at an extremely rapid pace. The problem is the demand grows faster,” Al Falih says.

Aramco started the first phase of its first non-associated gas field Karan last summer. Al Falih says the full project, which will take the capacity of the field to 1.8 billion cubic feet per day (bcfd), is expected to be on stream in the summer, earlier than expected.

He says Aramco is considering developing new gas fields, Midyan and Sidr, in the Northwest area to produce gas for power plants and potentially to supply other industries in a region rich in iron ore deposits.

“Midyan and Sidr are two fields adjacent to each other. We have already discovered them,” Al Falih says. “Now we are working on the development plan so these two will be coming in our business plan.”

An industry source says Aramco was still estimating reserves at Midyan.

Al Falih says Aramco is still trying to confirm the exact the size of the Jalamid field it discovered in the north of the kingdom which would feed a new mining project close to the Jordanian border.

Saudi Arabia, home to the world’s largest oil reserves, is keen to develop its mining industry to diversify the economy away from relying on oil.

Saudi Oil Minister Ali Al Naimi said in December his country had discovered commercially-viable volumes of gas in the Red Sea, in the north of the kingdom and in the Rub Al Khali or Empty Quarter.

Aramco also plans to boost its refining capacity to 8 million barrels per day (mbpd) in a decade and wants to integrate refineries with petrochemicals production to boost profits.

Aramco and Sinopec are in talks to integrate petrochemical production with the refinery in Yanbu they plan to bring on stream in 2014, Al Falih says.

“It makes a lot more sense that we have tighter integration between the production of the crude oil feedstock and the refining operation and then provide products to the market,” he says.