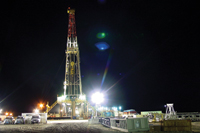

Rigs ... seeing more deployment

Rigs ... seeing more deployment

SAUDI Arabia is deploying the most oil rigs in four years as it prepares for possible shortages caused by tension with Iran. The number of rigs used in the desert kingdom more than doubled in January from a year earlier, the biggest annual increase on record, data from Houston-based Baker Hughes shows. As much as 1 million barrels per day (mbpd) of Iranian crude exports may be lost as the US and Europe tightened sanctions against President Mahmoud Ahmadinejad’s government over its nuclear programme, the International Energy Agency says.

Brent, the benchmark for more than half the world’s oil, rose to a 10-month high, propelling US retail gasoline to the highest ever for this time of year. Democrats have urged Obama to tap the nation’s Strategic Petroleum Reserve for the 18th time since 1985. Iran’s buyers in Asia and the European Union are cutting purchases to comply with sanctions, raising demand for alternatives at a time when supplies are disrupted in Yemen, Libya, Syria and South Sudan.

“There’s a desire in Saudi Arabia and the US to control price volatility and reassure the market,” Sadad Al Husseini, founder of Husseini Energy consultancy in Dhahran, says.

That “is why Saudi is pumping near record levels. Releasing oil from the SPR would be one of the dumbest things to do.

They are just saying that to try and bring prices down.” He is a former executive vice president for exploration and development at state-run Saudi Arabian Oil Co.

Oil surpassed $120 a barrel on February 20 for the first time since May, when conflict in Libya had all but shut off exports from the north African country, as the sanctions against Iran, Opec’s second-largest producer, renewed concern supplies will be disrupted.

Libyan supplies are about 460,000 bpd lower than the 1.6 mbpd rate in January 2011, before the uprising against Muammar Qaddafi began, according to a survey of oil companies, producers and analysts.

About 600,000 barrels have been lost because of fighting in Yemen and Syria and a halt to supplies in South Sudan because of a dispute with its northern neighbour, according to the Paris-based IEA.

Saudi Arabia used 49 rigs in January, compared with 48 in December and 23 a year earlier, Baker Hughes, the world’s third- largest oilfield-services provider, says.

The nation employed an average of 47 rigs in the fourth quarter, up from 39 in the previous three months. Rig use peaked at 57 in August 2007, as the country implemented a programme to boost capacity to 12.5 mbpd.

Saudi Arabia supplied 9.4 mbpd of crude to the market in February steady from January, an industry source familiar with the matter says.

“Production from the kingdom was in the range of 9.85 million bpd also steady from the previous month,” the industry source adds.

With Iran facing new sanctions over its disputed nuclear work which the West fears might be aimed at making atomic bombs, customers of Iranian crude have already started cutting down on orders. The country boosted output to 10.047 million in November, the highest level since at least 1980.

“The kingdom is responding to demand for more crude, and part of this demand is related to upcoming sanctions on Iranian oil,” Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas in London, says.

“What could motivate a use of strategic stocks is the lost volumes of Syria, Yemen and South Sudan combined. Here you face actual supply disruptions, so the US and the IEA may decide to release oil to bridge the gap as Saudi continues to pump more.”

China, Japan, India and South Korea, which together bought 59 per cent of Iran’s oil in the first half of last year, are deepening ties with Saudi Arabia before US sanctions against financial institutions against the Islamic republic take effect at the end of June.

Chinese Premier Wen Jiabao, South Korean President Lee Myung Bak and Japanese Foreign Minister Koichi Gemba visited Riyadh this year to strengthen relations, while India asked for more oil.

Saudi Aramco is bringing the Dammam field, its oldest, back on stream this year, according to the Economist Intelligence Unit. The heavy crude is a “good” replacement for Iranian oil, said Caroline Bain, a senior economist at the London-based EIU.

|

|

Libyan oil suffered disruption |

“One explanation for reviving fields like Dammam is that the Saudis are currently overestimating their spare capacity, so they are drilling more as it looks like they may actually need to use it,” Bain says. “We estimate them to have about 3 million barrels a day spare currently, but perhaps the amount that’s readily available would be quite a lot less than that.”

The Obama administration is considering tapping the strategic reserve, Energy Secretary Steven Chu says amid rising fuel prices. Gasoline this week averaged $3.721 a gallon, 10 per cent above the levels of a year ago and the highest for this time of year in Energy Department records starting in 1973.

Representatives Ed Markey of Massachusetts, Peter Welch of Vermont and Rosa DeLauro of Connecticut, asked Obama February 22 to release oil from the strategic stockpile. Republicans opposed the request.

“Releasing oil from the Strategic Petroleum Reserve would be, at best, a short-term benefit,” Senator John Barrasso, a Wyoming Republican, says. “This purely political move would cause more harm than good.”

The Republicans, the energy industry and some Democrats oppose a release now, saying supplies must be available, for example, in the event Iran blocks the Strait of Hormuz, the transit point for 20 per cent of the world’s oil.

“Saudi drilling is mostly independent of the use of the SPR because they act on different time horizons,” Jeffrey Currie, head of commodities research at Goldman Sachs Group in London, says.

“New rigs are going to have an effect in the medium-to-longer term, while the SPR is a short-term tool. The Obama administration has used the SPR before, so, if the circumstances were right, I wouldn’t rule its use out.”

Aramco has plans to raise the number of drilling rigs it operates to pre-crisis levels of at least 130 by the second quarter of 2012 as it strives to maintain production capacity levels, industry sources say.

Aramco had seen a sharp decline in rig count from 130 to 104 after the global economic crisis hit demand in 2009. Half of the addition will be for Manifa, an industry source who declined to be identified told Reuters, as Aramco expedited plans to bring the 900,000 barrels per day bpd oil field on line by 2014.

“The plan is to increase rigs by the second quarter, whether they make it or not is a different story,” said one source, adding the plan is to have 135 rigs in operation.

Industry sources had expected Aramco to keep the level of rigs it operates little changed from 2010 but following disruptions to Libya’s output earlier this year Saudi Arabia increased output.

In March, Simmons & Co analyst Bill Herbert said the state-run energy firm met leading oil service companies including Halliburton to discuss plans to boost the country’s rig count in 2011 and next year to 118, from around 92 then.

“The number of rigs has increased since we want to increase the maintenance of our fields,” says a Saudi industry source.

The largest Opec producer and the world’s largest oil exporter is pumping oil at the highest rate for decades. It exported 8.1 mbpd of oil in November, 1.2 million more than its average daily exports during the first nine months of 2011.

“They want to maintain potential, primarily in oil drilling, what they are looking at is to be able to move production up or down depending on what is happening in the world market, they want to have capacity to be able to have flexibility in production,” says a source, who declines to be identified.