Bichsel ... seeking new opportunities for Shell

Bichsel ... seeking new opportunities for Shell

TECHNOLOGY is the key enabler for Shell’s exploration, development and production strategy. Not surprisingly then, over the past five years Shell has invested well over $5 billion in research and development (R&D), which is actually the most compared with any of its international oil company peers.

“Getting the most out of existing reservoirs and fields has never been more important, and will become even more so in the future. Technology innovation and application play a key role,” says Matthias Bichsel, director, Shell Projects and Technology, member of the executive committee of Royal Dutch Shell, in an exclusive interview with OGN.

Shell, says Bichsel, is very good at not only exploring but also finding the solutions to go into frontier areas. “It’s an area where we are spending significant amounts of money. We have spent last year about $3.6 billion in exploration. We have a good portfolio of near-field exploration opportunities on a global basis, opening up new frontiers,” he says. “We have been at it for decades and it is amazing how much there still is to innovate and discover,” he adds.

The company sees new opportunities emerging in liquid-rich shale or the tight gas which is a huge revolution driven by technology in the US and Canada. “We see more opportunities in North America, in North Africa, in Europe, in China, in Australia and I am sure there are places where we do not even really know. Shell also hopes to drill in Alaska in 2012 and again, in the Arctic too where we see a very significant hydrocarbon resource base to be discovered,” he adds.

Alongside, as Shell is working on advanced, next-generation biofuels, it is however focused on finding, developing and producing more hydrocarbons. “All said and done, alternative energy is still a nascent technology, which is not our strength, whereas fossil fuel is,” he says.

Excerpts from the interview:

What is the future of oil and gas in an uncertain world? What is Shell doing to solve the world’s energy challenge?

The global energy challenge is facing all of us. It is a big one. The world’s energy demand looks like doubling by 2050 from current levels.

When we look forward to 2030-2050, we realise that the world has growing needs for energy, which is driven by the growing population. But as we look at the economies, particularly, the emerging economies in the East – China, India and Indonesia, and also Brazil and Africa … we see these economies are moving in a very energy intensive phase of their development. So their energy needs are increasing.

Indeed, while undoubtedly alternative energies will be able to meet some of the energy needs, the future of oil and gas continues to be bright since fossil fuels will still be supplying some 60 to 65 per cent of global energy in 2050.

A combination of nuclear and fossil fuels – coal, oil and gas will continue to be the predominant fuels. And proportionally more gas is the solution, as gas is a cleaner form of energy. So basically, gas is a solution to sustainable development of the world, recognising that fossil fuels will still play a role for quite a while. So, the need to find more and produce more oil and gas will increase.

Getting the most out of existing reservoirs and fields has never been more important, and will become even more so in the future. Technology innovation and application play a key role.

What are your long-term plans for the Middle East region, in general and Saudi Arabia in particular? What new projects does Shell plan to unveil in Saudi Arabia in future?

In the Middle East, we are always looking for new projects and new opportunities. While I can’t tell you anything about the new projects as it’s commercially sensitive but I can tell you about the recent projects that we have signed in the region. One project, I would like to mention is the one we have signed in Iraq, last November.

The joint venture held 51 per cent by Iraq’s South Gas Company, 44 per cent by Shell and 5 per cent by Mitsubishi Corporation is called Basrah Gas Company (BGC) and gathers raw gas that is currently flared because of a lack of infrastructure to collect it. The JV will collect and process raw gas from the Rumaila, Zubair and West Qurna 1 fields in the southern part of the country. The primary market for the gas will be Iraq, but there’s an opportunity eventually for an exports scheme.

That’s a few years from now. We have signed that last year in November and we are working together with our partners in refurbishing their gas plant and to install effectively the first power generation unit, which is very important for the region because it provides electricity effectively in Iraq. This to me is an exciting new opportunity that we have recently signed in the region.

What are the new technologies that Shell plans to bring to the Middle East, particularly in the areas of tight gas/ shale gas and enhanced oil recovery (EOR) areas?

Shell’s experience with EOR goes back decades: we pioneered the injection of CO2 into reservoirs in Texas back in the 1970s. We have a successful track record of thermal EOR operations. Nevertheless, today EOR still only accounts for about 2 per cent of our production.

But we have some 10 new projects under development or in operation, with a further 25 at field trial stage, and I expect that the contribution of EOR will steadily increase.

Earlier this year, we signed two 30-year contracts for offshore EOR projects in Malaysia, with hundreds of million additional barrels as potential prize.

Over the past five years we have continuously beefed up our EOR R&D teams that now comprise not just the traditional geoscientists and petroleum engineers but a whole raft of other disciplines including biochemists, materials scientists and process engineers. These all help to create the optimal EOR solution for each reservoir.

We have recently merged our upstream and downstream researchers. The synergistic benefits are already showing breakthroughs e.g. in the field of chemical EOR where our downstream chemical researchers are working hand in glove with their upstream reservoir engineering colleagues to arrive at the most suitable “chemical cocktails” to enhance further EOR.

My prediction is that in particular in the field of chemical EOR we will see further breakthroughs in the coming years and enable more and more fields to be considered for such treatment.

Getting more oil and gas from reservoirs makes a lot of sense, particularly in a world of higher oil prices and increasing capital costs. The ability to use existing facilities for longer than originally anticipated and the advent of cheaper drilling solutions allows cost effective EOR schemes. The Middle East is uniquely qualified to take advantage of this opportunity.

Could you give us an insight into Shell’s priorities and investments in major new capital projects?

First of all, we have a very important and large asset base in countries like Europe in the North Sea. We have, of course, an asset base in other parts of the world, too, like in Malaysia; in Brunei where we have been exploring, developing and producing for many years; in Nigeria; in the Middle East with our partners in Oman; and in the Gulf of Mexico … these are what we call our ‘heartlands’. These are areas in which we continue to invest significant amounts of money and we have some large projects that we undertake as capital projects. Then we have deepwater exploration and production.

It’s a key area for us and we are one of the global leaders for the last 30 years.

In Malaysia, we are currently working on the development of a big project—The Gumusut field offshore. We have several projects in the pipeline in the Gulf of Mexico including a six tension leg platform (TLP) project which is currently being constructed in South Korea and will be installed in the Gulf of Mexico.

We have made more exploration and discoveries over the past few years, which we are currently appraising, before we invest in the future. Another area is LNG. We have a number of large conventional onshore LNG projects going on, in particular in Australia. But we are pushing the envelope even further now, and pursuing the possibilities offered by offshore LNG processing – that is, liquefying the gas where it is produced, using what we call floating LNG (FLNG).

LNG technology is an important development for the LNG industry as it reduces both the project costs and environmental footprint of an LNG development, because there is no need for long pipelines to shore; compression platforms to push the gas to shore; near shore works such as dredging and jetty construction; and onshore development such as building roads, laydown areas and accommodation facilities.

Also, of course, it means that you can go to smaller fields because the facility is designed for a life of 50 years. So you can go to smaller fields of 4 to 5 trillion cubic feet, produce for 10 to 15 years and then move on to a next field. So we have a versatile solution and that is the new technology we are investing in.

We have our first project to build FLNG facility which will be deployed by Shell Development (Australia) at its Prelude gas field off the northwest coast of Australia. It is a game changing and innovative use of technology that will allow Shell to bring new energy sources to market, by accessing offshore gas fields that would otherwise be uneconomic or difficult to develop via a traditional land-based facility.

Another area where we are investing heavily is, indeed, in tight gas. This is not just gas, this is also oil; so we, of course, have an opportunity. We have quite a bit of acreage in the US, for instance, where we have successfully de-risked and explored and we are developing the liquids rich shale. This is gas with a lot of liquids and that’s, of course, a very exciting development. And you may know that US and Canada not long ago talked of importing gas for their own use.

Thanks to technology it’s possible now for them to become self-sufficient in gas and there’s even talk about exporting gas from the US and Canada to other parts of the world.

So you see how technology in a relatively short period of time can effectively turn the energy policy of a nation upside down and that’s a great opportunity. There’s a lot of gas there and that gas is really going off; so we have a large acreage base in the US. We have also started drilling last year in a number of basins together with our partner PetroChina /CNPC to explore for tight gas in China. We are also looking in Queensland in Australia together with our partner CNPC /Petrochina to develop a scheme for coal-bed methane or coal seam gas which is gas which sits in coal to liberate that and to feed that into an LNG plant in Queensland for export into Asia.

|

|

FLNG ... innovative use of technology |

As you navigate through this period of uncertainty, is it wise to pursue high-risk exploration and what are your production strategies in frontier territories?

Exploration is always high risk and that’s the nature of exploration. If it were low risk, everyone would have found it.

Clearly, to produce more oil and gas, you need to be able to detect and find more. The world is continuously looking for newer geological places. Over the past years, quite a number of new hydrocarbon provinces have opened up. I think right at the moment, for instance, it’s Mozambique in East Africa where large finds have been made – gas, in this particular case.

In West Africa, new opportunities are being opened up. We have all heard about the so-called pre-salt of the Santos Basin in Brazil where Petrobras and its partners have made discoveries and Shell is also a part of that. (Petrobras has made a new discovery of good quality oil during drilling of the well 4-BRSA-946C-SPS, informally known Biguá. The well is located in block BM-S-8 in the ultra deepwaters of pre-salt in the Santos Basin, 270 km off the coast of São Paulo, Brazil. Petrobras is the operator of the consortium (66 per cent) in partnership with Shell Petroleum Brazil (20 per cent) and Petrogal Brazil – Galp Energia (14 per cent)).

Then, new opportunities are emerging in liquid-rich shale or the tight gas which is a huge revolution driven by technology in the US and Canada. We see more opportunities in North America, in North Africa, in Europe, in China, in Australia and I am sure there are places where we do not even really know.

Shell also hopes to drill in Alaska in 2012 and again, in the Arctic too where we see a very significant hydrocarbon resource base to be discovered. As far as the strategies in frontier territories are concerned, I can say that we are very good at not only exploring but finding the solutions to go into frontier areas. It’s an area where we are spending significant amounts of money. We have spent last year about $3.6 billion in exploration. We have a good portfolio of near-field exploration opportunities on a global basis, opening up new frontiers as we just discussed.

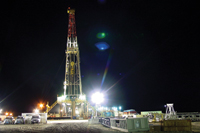

Shell, for instance, has the deepest producing and drilling facility in the Gulf of Mexico where we have recently drilled the deepest development well in the world at the water depths of nearly 3,000 metres.

So, it is all about pushing ahead the frontiers further out by using the technology, by using the ingenuity of mankind to find the right strategies to find, develop and produce more hydrocarbons.

Shell invests a lot of money in technology. How do you spend the billions of dollars budgeted for your research and development (R&D)?

We have always had the strategy of using technology. Technology is the key enabler for our exploration, development and production strategy. It underpins the whole strategy and for that reason we have decided to invest a lot of money. In fact, over the past five years, we have invested well over $5 billion in R&D which is actually the most compared with any of our direct competitors. By that, I mean, Shell maintains the biggest R&D and technology deployment spend at $1.1 billion annually.

We have a range of technologies which are from supporting exploration to finding new technologies to extract new hydrocarbons to finding new ways of reducing the environmental footprint of, say, finding shale gas.

We also have a much focused programme on the downstream side. For instance, we are investing in making more efficient fuels. Shell has developed new lubricants and we continue to develop these new fuels which give consumers the opportunity to drive more on a litre of gasoline or the lubricants which basically reduce the friction … which means you are using less fuel.

So we are working towards an opportunity where consumer gets more bang for his buck.

In parallel, we are working on advanced, next generation biofuels. We have recently, invested in a joint venture called Raizen with a Brazilian producer of ethanol from sugar cane, Cosan, whereby we bring our marketing and retail expertise into the mix and they bring their manufacturing approach to harvesting sugar cane and producing ethanol.

We are currently producing about 2 billion litres of ethanol which is distributed in Brazil through a combined network of about 4,500 service stations. We are working on better products and more efficient fuels, as well.

That’s an opportunity eventually we hope to increase and hopefully we will also export because ethanol from a green point of view, probably, is the cleanest of biofuels. So that shows the breadth of spread of our R&D activity.

Going forward, will Shell’s investments skew more towards alternative energies rather than fossil fuels?

As already indicated we spent significant amounts of money on biofuels and advanced next-generation of biofuels from a research point of view.

We are also developing advanced biofuels from non-food sources and using new conversion process: these have the potential to offer fewer CO2 emissions and can be blended in higher proportions with petrol and diesel than today’s biofuels.

We have a number of collaborations with leading biotechnology companies and academic institutions that help us to develop advanced biofuels. We also have a new technology which is to go from the biomass into sugar and then directly without byproducts straight into fuel. We have a joint technology development programme with US company Virent to directly convert plant sugars and non-edible biomass into a range of high performance liquid transport fuels. All that’s very exciting, though these are early days but this is a key area. We are an investor in wind energy, too – most of it is n the US, with some in Europe. We have equity in wind projects with about 1 GW of capacity installed, currently.

We also have partnerships, like the Showa Shell Sekiyu, which is a Japanese company and where we are an investor. In fact, they are a solar energy company but our main focus is on biofuels in alternative energy. Another thing I would like to mention in that space is Carbon capture and storage … that’s a very important technology. CO2 capture and storage is a cornerstone of sustainable development, when it comes to dealing with oil.

We have an active programme in which we are doing research and technology development in a number of areas, such as capture of CO2, sequestration, monitoring, etc. We are involved in several JIPs (joint industry projects) covering a range of aspects. We participate in several research projects that inject CO2 into saline aquifers and monitor those injections, observing where their plumes go, so that we can eventually go confidently into carbon-capture-and-storage solutions.

We are working in partnership with Chevron and ExxonMobil on what is currently the largest CO2-capture and-storage project in the world, the Gorgon LNG project in Australia, which will eventually sequester about 4 million tonnes per annum of CO2.

We also are working with the Alberta and Canadian governments on a project called Quest, which is about taking high-concentration CO2 streams from our Scotford Refinery, where we process the oil sands from our Athabasca mines, and then taking that CO2 about 200 km to the west, where we inject it into a saline aquifer.

This is a big project; it will tackle about 1 million tonnes per annum of CO2 and hopefully we will get the greenlight for this project. We are also working on other number of projects which are large commercial scale projects and are a very important element of technology which, of course is not alternative energy, but it makes fossil fuels clean so that they can indeed compete with the alternative energies.