Srak ... confident of making Kidan commercially viable

Srak ... confident of making Kidan commercially viable

SAUDI Arabia will not be able to develop the known gas resources in the Rub Al Khali desert until the government raises the domestic gas price, according to Saudi Aramco president Khalid Al Falih.

“One challenge we have is the pricing of gas is very low in Saudi Arabia and does not make unconventional gas or tight gas in the Rub Al Khali economic,” he says.

Aramco and its international partners drilled 27 wells in the the first exploration phase carried out in the vast desert in search of gas, but with few positive results.

China’s Sinopec found deep, tight gas, Royal Dutch Shell appraised a known sour gas field, and Russia’s Lukoil announced a find, but none of the ventures have declared commerciality.

This has not stopped the Shell-led South Rub Al Khali (Srak) venture and Sinopec’s Sino-Saudi Gas (SSG) from signing up to a second exploration phase. Lukoil’s Luksar declined a second drilling campaign, but opted for an appraisal programme on two discovered structures. Eni and Repsol’s Enirepsa venture intended to pull out of the country years ago after drilling dry wells, but the government gave it more time to finish its four-well drilling programme out until at least 2011.

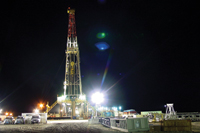

Srak is confident that – together with its partner Aramco – it can find a way to commercially develop the Kidan sour gas field, despite the remote location and huge logistical challenge of stripping out tonnes of sulphur to make the gas usable.

The government mandated gas price is 75¢ per million Btu, but development of Kidan will cost many multiples of that, say the partners.

The decision to change the fixed domestic gas price lies with the most senior members of the Saudi leadership. Aramco has tried to lobby for a change in gas price in recent years, particularly as the state company develops non-associated gas fields, but the government has dismissed those requests. There were indications that the top leadership was considering a rise in gas prices in 2010 in response to alarming local consumption trends, but that was before the Arab Spring rocked the Mideast in 2011 and forced government priorities elsewhere.

Al Falih says he hoped the gas price issue “will be addressed by the government in due course” but did not give a timeline. Unlike Shell, Sinopec is not focused solely on the commercial value of its upstream stake in the kingdom. “We are not just looking at the project level, we are looking at the strategic level,” says Sinopec Chairman Fu Chengyu. Fu was in town to sign the joint-venture agreement for Sinopec and Aramco to build a 400,000 barrels-per-day refinery on Saudi Arabia’s west coast.

Al Falih defends Aramco’s gas development schemes, which have lagged domestic demand for gas to fuel power stations. “We have been growing our gas at an extremely rapid pace. The problem is that the demand grows faster than our extremely rapid supply growth,” he says.

Aramco will ramp up the 1.8 billion cubic foot per day Karan field, which began early production last summer, in the “coming months,” he says.

Its 2.5 bcfd Wasit development will process gas from two offshore fields, Hasbah and Arabiyah, by 2014, he adds. More will come from debottlenecking existing facilities.