Al Falih ... advocating prudent tapping of fields

Al Falih ... advocating prudent tapping of fields

SAUDI Aramco’s sustainable production capacity will rise to 12.9 million barrels per day (mbpd) once the Manifa heavy oil field development is completed, but the state-owned giant intends to relax production from some of its older reservoirs to achieve maximum recovery rates, CEO Khalid Al Falih says.

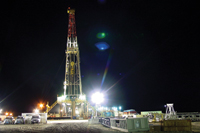

The development of the offshore Manifa oil field is the last of Saudi Aramco’s planned capacity expansion projects and is being brought on stream in two phases. The first 500,000 bpd increment is due in June 2013, rising to 900,000 bpd in 2022. With the Manifa increment, Saudi Aramco will maintain its total production capacity at 12 mbpd, a number that Al Falih says is nominal.

“First of all when we talk about a capacity of 12 mbpd, you are talking nominally. That does not mean that we cannot produce 12.5 mbpd. When we set a maximum sustained capacity, it does not mean that that is the production ceiling when we fully open the valves. Every well we have is choked. There is a production level that we try to shoot for that allows us ultimate maximum recovery from that area from which the well is drawing crude oil,” Al Falih says.

“With time, we reduce production from certain areas of the reservoir and we move to fresh or virgin fields so that we maintain economically optimum production over the long term,” he explains.

“Some of our older reservoirs that have been going for 50-60 years at certain production levels need to be relaxed at some point or another, because they are more expensive to produce than our less mature reservoirs,” he adds.

The Khurais field, for example, has capacity of 1.2 mbpd, Al Falih says. “Today, Khurais can produce for a year or more at 1.4 mbpd, both from the wells and processing facilities. The 1.2 mbpd is when you start having water ingress, which we do not. We have zero water cut in Khurais today,” he says.

“If I tell the head of our upstream to maximize Khurais, he can easily do 1.4 mbpd in 2012. Ultimately, when Manifa comes on stream, we will be relaxing some of the production that is available today from some of our mature reservoirs so that 50 or 60 years we will have the ultimate recovery rates that we aim for and which we would not have if we kept producing at maximum rates from some of the more mature reservoirs,” he says.

“That does not mean we are abusing them today, but we do not want to be abusing them 10 years from now. That means that when Manifa comes on stream, if we continue producing all of those reservoirs at the same rate, we will have 12.9 mbpd.

But we are not going to do that. Once we do it, we will introduce reservoir management restrictions to relax those fields, because we are aiming for later in this century and beyond to be able to achieve our maximum reservoir recovery.”

The kingdom’s total production capacity currently stands at 12.5 mbpd, including the neutral zone shared with Kuwait.

“Saudi Arabia’s production includes Aramco’s production and the production of other entities. We are not the only producer in the kingdom.”

“There is Saudi Chevron and there is AGOC and our production from the Abu Safah field, which is shared with Bahrain,” Al Falih says when asked to comment on remarks by Saudi oil minister Ali Naimi in Durban that total output had topped 10 mbpd in November.

|

|

Khurais ... having potential to give more |

“The figures that the minister mentioned could also include other liquids, such as condensate. It is not fair for me to try and dissect a number that was mentioned without me being there and without knowing the full context. I can confirm to you that Aramco’s production has recently been significantly above 9 mbpd despite the seasonal decline of crude burning,” Al Falih says, referring to the volumes of crude oil used for power generation in the kingdom.

There have been varying figures for the volume of crude oil burn in Saudi Arabia, which tends to vary seasonally and is higher during the hot summer months.

“I have seen 900,000 bpd and 1 mbpd, which are absolutely incorrect. I believe 500,000 bpd is in the range of the annual average crude oil being burned for power generation,” Al Falih says.

The Aramco boss has said previously that sustained high consumption would impact the kingdom’s crude oil export volumes in the future. “Today if you look at our total energy consumption in barrels, oil equivalent (boe), it is in the range of 4 mboed, give or take a couple hundred thousand. About 50 per cent of it is gas-based. This includes feedstock into petrochemicals, some of it is LPG, some of it is ethane, some of it is natural gasoline which is a form of naphtha, but it is all derived from gas,” Al Falih explains.

“Of the other 2 mbpd, a lot of it goes into refined products and there is the 500,000 bpd of crude that goes into utility applications. I believe that what I says was that consumption will double by 2030 to 8.2 mbpd if we do absolutely nothing,” he says.

“We are not going to do absolutely nothing. If we do not introduce efficiency measures, if we do not sharpen our consumption pattern, if we do not substitute different energy sources, if renewables do not make a dent into our energy mix, that will be the outcome. The reason for that speech was basically to create what you would call a ‘burning platform’ for people to take action and I think it has worked.”

“You have seen within Saudi media, amongst decision makers and intellectuals a lot of debate since that talk I gave in Riyadh about needing to change the trajectory of our energy intensity. Those of you who were in Riyadh last week for the inaugural conference of the King Abdullah Petroleum Studies and Research Centre, saw the kind of questions that were constantly coming up and everybody seems concerned today.

We are committed and at Saudi Aramco we are partnering with all other stake holders to ensure that we do not end up consuming 8 million boe/d for the size of the economy that we will have, because it will be extremely inefficient in terms of converting energy input into economic output.”

Saudi Aramco also has conceptual estimates of its tight and shale gas reserves but has not yet booked recoverable reserves until it completes an assessment of its unconventional gas resources, Al Falih says.

“We have numbers that geologists present to us, but they are still conceptual estimates. We really do not have booked recoverable reserves in terms of unconventional resources, because until you can know with certainty the resource base and drill enough wells to know the reservoir characteristics, and whether it is homogeneous or heterogeneous, and more importantly until you prove that it can be produced commercially, you cannot book them,” Al Falih says.

“So what we have now are conceptual resource estimates. We know the resource base is there, but how much it is and when will we be able to put it down as a commercially recoverable reserves, we have some more work to do. I have mentioned before that our resource base is in the hundreds of Tcfs. Hundreds can become smaller if you go with P90, the 90 per cent probability. On the other hand, it will be much larger if you used P10 figures, and something in the range of 200 to 300 tcf range if you are looking at the mean estimate,” he adds. “But at this stage, I would just caution it is still estimates of resources, conceptual in nature, and it will take a couple of years of intensive exploration and perhaps piloted production of this type of resources before we tell with certainty how much reserves we have and when we will be able to bring it to market,” Al Falih says.