![]() Reduced demand and lower oil prices were reflected in its Q2 results. However, it delivered solid earnings because of low production costs, unique scale, agile workforce, and unrivalled financial and operational strength, said its top official. 'Despite Covid-19 bringing the world to a standstill, Aramco kept going. We have proven our financial resilience and operational reliability, setting a record in our business operations, while at the same time taking steps to ensure the health and safety of our people,' Aramco President and CEO Amin H Nasser said confidently. The company demonstrated reliable upstream performance with total hydrocarbon production of 12.7 million barrels per day (bpd) of oil equivalent in Q2 2020, and a historic highest single day crude oil production of 12.1 million barrels on April 2, 2020. Nevertheless, production is only set to increase as Aramco plans to boost crude output capacity by 1 million bpd to 13 million bpd despite cuts in capex this year and next year, Nasser said. The company is expected to make significant efforts on crude oil and gas expansion, according to GlobalData, which reported major expansions at offshore oil fields of Marjan, Zuluf, Safaniyah and Berri to comprise the majority of the company’s upstream investment over the next three years. Two new oil and gas fields — Abraq Al-Toloul oil field and Hadabat al Hajara gas field — were added to the list late last month. The company expects capex for 2020 to be between $25 billion and $30 billion. Its previous capital spending guidance was $40 billion to $45 billion.

Downstream Delivers

Aramco’s downstream business continues to deliver on its long-term strategy of strategic integration and diversification. In July, the company announced a new operating model to help streamline operations and reinforce Aramco’s position as a major global energy and petrochemicals player. This is an acknowledgment by Aramco that the future of oil is chemicals. Last year, Nasser pledged $100 billion in petrochemical investment over the next decade. 'The restructuring sees the streamlining of the combined Aramco/Sabic downstream operation into four commercials that aim to improve management of the company’s massive global downstream portfolio, which includes assets in Japan, South Korea, Indonesia, Malaysia, China, Bangladesh, India, Pakistan, Egypt, South Africa, the Netherlands, the UK and the US,' said a GlobalData report. Petrochemicals are rapidly becoming the largest driver of global oil demand. According to the International Energy Agency (IEA), the growth in demand for petrochemical products means that petrochemicals are set to account for over a third of the growth in oil demand to 2030, and nearly half to 2050, ahead of trucks, aviation and shipping. Petrochemicals are also poised to consume an additional 56 billion cu m of natural gas by 2030, equivalent to about half of Canada’s total gas consumption today. In this respect, the $69-billion acquisition of Saudi Basic Industries Corporation (Sabic) in June was perhaps the best thing to do. The deal positions Aramco as a key player in the more profitable petrochemicals sector. 'The world’s biggest company aims to double its downstream output by 2030, increasing overall refined output from around 5.4 million bpd currently to 8-10 million bpd, and petrochemicals production from 16.8 to 34 million tonnes a year, excluding SABIC. With the completion of the Sabic acquisition, Aramco’s petrochemicals business now has a total production of about 90 million tonnes a year,' said GlobalData.

Global investments

The uncertainty surrounding global oil demand has forced Saudi Aramco to make prudent decisions regarding global investments. The first in this series has been the delay in a $15-billion deal with Indian Reliance Industries for a 20 per cent stake in its oil-to-chemical. Chairman of the Indian conglomerate Mukesh Ambani blamed the uncertainty in the energy market and the Covid-19 situation for the delay. This was followed last month by Aramco suspending a deal to build a $10 billion refining and petrochemicals complex in China’s Liaoning province after negotiations with its Chinese partners, Reuters reported. The joint venture was signed by His Highness Crown Prince Mohammed bin Salman in Beijing in February last year. According to plans, Aramco had agreed with Norinco and Panjin Sincen to establish the Huajin Aramco Petrochemical Company for a 300,000-bpd refinery, with 70 per cent of the crude being supplied to it by Saudi Arabia. Aramco was also in talks with Indonesia’s state energy company Pertamina earlier this year over a refinery expansion project, but negotiations ended without an agreement.

Gas ambitions

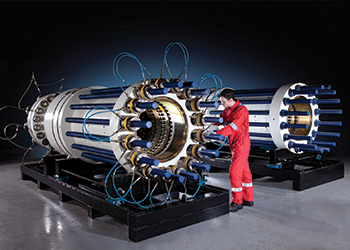

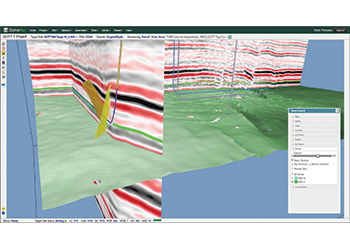

By 2030, Aramco plans to be among the world’s top three natural gas producers and export gas for the first time. This is in line with the company’s plans to meet future global and domestic energy demand for power generation and industrial sectors as it is important for the world’s energy transition and reducing the global carbon footprint. Aramco Vice-President of Gas Operations Abdullah Al-Ghamdi said there was a dual challenge of meeting growing energy demands, but at the same time reduce greenhouse gas emissions. With extensive high-quality gas reserves, and exclusive access to its large and growing domestic marketplace, a significant portion of Saudi Aramco’s current exploration activities relate to gas. Increased gas production will come from infrastructure increments to current projects and large untapped gas reserves not associated with oil production, such as unconventional gas fields in the Kingdom’s north. Aramco’s gas production is expected to double in the coming decade to 23 billion standard cubic feet per day (scfd). As of December 31, 2019, Saudi Arabia had proven natural gas reserves of 237.4 trillion standard cu ft. It currently operates 10 gas processing plants — Berri, Shedgum, Uthmaniyah, Hawiyah, Haradh, Khursaniyah, Wasit, Midyan, Fadhili, and North Arabia. The Fadhili Gas Plant meanwhile reached its full production capacity of 2.5 scfd during Q2 this year, after successfully completing its commissioning activities. Also, in February this year, Aramco received regulatory approval to develop its largest unconventional gas field. The Jafurah field in the Eastern Province spans 17,000 sq km and has an estimated resource of 200 trillion cu ft of rich raw gas. The company will spend $110 billion to develop the project. The new shale gas development will help the Kingdom to reduce burning an average of 800,000 barrels per day of crude and fuel for electricity, freeing up more crude for export if needed, and reduce emissions. Separately, for the Hawiyah Unayzah Gas Reservoir Storage (HUGRS) project Siemens Energy will be providing centrifugal compressor systems. The engineering, procurement, and construction (EPC) contract for the entire project was given earlier this year to Samsung Engineering. The project, located 260 k m east of Riyadh, includes a plant that will take surplus pipelines gas in the winter months and inject it into an existing depleted field. The plant includes a gas injection facility with a capacity of 1,500 million standard cu ft per day (MMSCFD) and a withdrawal facility capable of processing up to 2,000 MMSCFD of gas. Siemens Energy will supply the required 20 compression trains. Ten trains will be built for the injection portion of the plant, and another 10 trains will be used for the withdrawal portion of the plant. Saudi Aramco is also pursuing investment and joint venture opportunities outside the Kingdom in natural gas and LNG projects, Al-Ghamdi said.

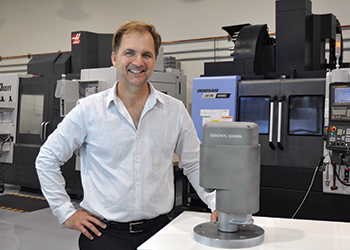

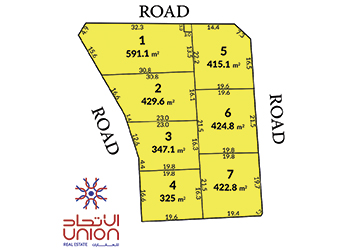

Localisation efforts Fundamental to Aramco’s commitment towards a diversified and sustainable Saudi energy sector as envisioned by Vision 2030 is its In-Kingdom Total Value Add (IKTVA) Program, which has contributed to a significant expansion of Saudi Arabia’s industrial base, attracting an estimated capital expenditure of $6.5 billion. The advantages of IKTVA have become all the more evident during the ongoing Covid-19 crisis when supply chains were greatly disrupted. Such a situation can put an organisation in a chokehold. IKTVA ensured that Aramco’s supply chains remain uninterrupted, mitigating the impact of the pandemic on its operations. The programme has resulted in a robust commercial ecosystem that continues to function despite the global pandemic in addition to creating jobs for Saudis and promoting investment. IKTVA has been incorporated into 750 Aramco contracts valued at more than $100 billion and the award of 50 Corporate Purchase Agreements (CPAs) worth $29 billion. Some 66 new IKTVA agreements worth a total of $21 billion were signed early this year. So far, 108 manufacturing facilities are either operational or under construction. IKTVA seems a win-win for everyone. For Aramco’s suppliers, their spending has tripled on goods and services sourced from the local market, while the programme has doubled suppliers’ spending on Saudi wages and more than tripled their spending on Saudi training and development. Companies have also increased spending on R&D, resulting in the emergence of new, homegrown technologies. IKTVA has also spurred a series of high-profile investments in Saudi Arabia and driven a number of anchor projects to catalyse the localization process, such as the King Salman International Complex for Maritime Industries and Services, King Salman Energy Park (Spark). Operated and anchored by Aramco, Spark will capture the full economic value from energy-related goods and services in Saudi Arabia and throughout the region, localising value creation through dedicated industrial development. In July, the project announced 60 per cent completion of its first phase, which consists of infrastructure, roads, utilities, and real estate assets established across 14 square kilometers, in addition to a dedicated 3-sq-km logistics zone and dry port. A total of SR6 billion was invested in the phase. Spark is set to be completed in 2021 and will add nearly $6 billion annually to the Kingdom’s GDP. Additionally, for the purpose of identifying new opportunities and adapting to a rapidly evolving global landscape, Aramco created a new Corporate Development organisation and mandated it with creating value, assess existing assets and secure greater access to growth markets and technologies through portfolio optimisation and strategic alignment. Set to become operational starting September 13, the organisation will be led by Senior Vice-President Abdulaziz Al-Gudaimi, reporting directly to the President and CEO. Another internal change was the appointment of Mahdi Aladel as new CEO of Aramco’s $500 million venture capital and investments arm, Saudi Aramco Energy Ventures (SAEV), according to a Bloomberg report. SAEV invests in early-stage oil, gas, renewable and chemicals technologies, and spends several million to tens of millions of dollars on each acquisition, focusing on companies developing drilling techniques, chemical applications or blockchain-based trading.

|

The Fadhili Gas Plant reached its full production capacity during Q2 2020

The Fadhili Gas Plant reached its full production capacity during Q2 2020

.jpg)