.jpg)

Saudi Arabia needs to manage its limited gas supply well

Saudi Arabia needs to manage its limited gas supply well

The country must find the right balance to address the competing household and industry needs, regional industry players say

Saudi Arabia needs to beef up its gas output to support its petrochemical expansion, while catering to rising energy needs of its rapidly growing population, industry sources in the Middle East say.

Consumption of natural gas in the country is expected to double by 2030 from 3.5 trillion cubic feet (tcf) per year in 2011, according to government estimates.

Saudi Arabia must find the right balance to address the competing household and industry needs, regional industry players say.

"Saudi Arabia will need to provide gas for domestic consumption and petrochemical production. The country needs to manage its limited gas supply well," a Dubai-based energy distributor says.

The country’s gas reserves stood at 288.4 trillion standard cubic feet as of end-2013, with annual gas production pegged at 4.0 tcf, data from state-owned energy firm Saudi Aramco shows.

More than half of Saudi Arabia’s proven natural gas reserves are found at the Ghawar, Safaniya and Zuluf oil fields, according to the Energy Information Administration. Its average gas production per day, based on raw gas to gas plants, stands at 11 billion standard cubic feet, according to Saudi Aramco.

The country’s population, which stood at 30 million in end-2013, is estimated to grow at an annual average of 2 per cent, according to the World Bank.

For now, its domestic natural gas requirements can be sufficiently covered by its own production. But by the end of next year, a new world-scale Sadara petrochemical complex in Jubail is due to start up and this may compete with household requirements.

The petrochemical complex, which is a joint venture between Saudi Aramco and US petrochemical major Dow Chemical, is expected to produce more than 3 million tonnes/year of high value-added chemical products and performance plastics.

Comprising 26 manufacturing units, the Sadara complex will be the first in the Middle East that will be able to use refinery liquids like naphtha as feedstock for production, other than ethane.

Market players warned that if Saudi Arabia were to switch entirely to using naphtha for petrochemical production, it will lose its competitive advantage.

"The capacity coming out of Sadara is massive and will significantly boost the petrochemical output coming out of the Middle East," according to a Saudi-based buyer.

The complex will include a world-scale cracker and production units for polyurethanes (isocyanates and polyether polyols), propylene oxide (PO), propylene glycol, elastomers, linear low density polyethylene (LLDPE), low density polyethylene (LDPE), glycol ethers and amines.

Saudi petrochemical giant Sabic, also cognisant of the need for feedstock diversification, plans to build an oil-to-chemicals complex for start-up in end-2020. The project is expected to use around 10 mtpy of crude oil to produce petrochemicals and speciality chemicals.

"Saudi will look to ramp up gas production in the coming years with a number of large-scale projects," a Middle East petrochemical buyer says.

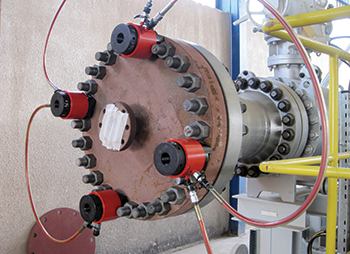

Saudi Aramco is expected to complete construction of Wasit Gas Plant sometime this year.

Once completed, Wasit will supply 1.7 billion standard cubic feet per day of non-associated gas to the Master Gas System, the country’s main pipeline network.

Wasit will allow Saudi Aramco to increase gas production significantly from fields not shared with oil wells.