Sabic ... going through testing times

Sabic ... going through testing times

Sabic’s restructuring plan aims to achieve the Saudi Vision 2030 targets and includes boosting the company’s performance efficiency and increasing its competitive ability on the global level to be more flexible to face the rapid variables in business

Petrochemicals giant Saudi Basic Industries Corp (Sabic) has combined its chemicals and polymers businesses and will spin off its steel unit as part of its restructuring efforts to counter the depressed oil market and weak product prices.

This was revealed by Chief executive Yousef Abdullah Al-Benyan after the firm, one of the world’s largest petrochemicals groups, reported a 6.8 per cent drop in third-quarter net profit, its ninth successive quarter of declining earnings.

Global petrochemical companies have been hit hard by low oil prices, which have dragged down product prices and forced firms to implement cost-saving strategies aimed at stemming the damage from lost revenues. Having already reorganised its innovative plastics unit – the old GE Plastics business it bought in 2007 – at the end of 2015, Benyan says Sabic had combined chemicals and polymers into one unit called petrochemicals. It would also reclassify its struggling Hadeed steel firm as an independent company in which Sabic would retain ownership but Hadeed would market its products and manage itself. No timeframe was given for this move.

"Restructuring had a positive impact on our performance in 2016 and it will help Sabic to maintain strong operations and face challenges through cutting costs and increasing reliability," Benyan says.

Sabic has reduced its cost of sales by 15 per cent and had increased its production by 3 per cent through efficiencies year-to-date, Benyan says, adding the company was seeking to do more as it expected 2017 to be "a quite challenging year for us".

Pressure on product prices remains a significant drag on Sabic – sales in the third quarter were down 10.8 per cent year-on-year to SR33.31 billion ($8.87 billion). This helped reduce net profit in the three months to September 30 to SR5.22 billion ($1.39 billion). While down from SR5.60 billion in the year-earlier period, it was broadly in line with the SR5.05 billion average forecast of five analysts polled by Reuters. Sabic’s share price was 1.8 per cent higher.

Sabic’s restructuring plan aims to achieve the Saudi Vision 2030 targets and includes boosting the company’s performance efficiency and increasing its competitive ability on the global level to be more flexible to face the rapid variables in the business environment.

Under the new plan, the polymers and chemicals sectors will be merged in a single strategic business unit (SBU) to enhance performance and focus on basic petrochemicals.

The company will also set up a new unit to define strategies and develop businesses, potential mergers, acquisitions, and joint ventures required for growth. Sabic will also merge its metals SBU with its subsidiary Saudi Iron & Steel Company (Hadeed) and separate its project and engineering management business from shared services.

Sabic is scouting for more overseas ventures to ease its dependence on domestic Saudi natural gas as it pushes ahead with its largest foreign investment with US partner ExxonMobil.

"We do have projects that we evaluate with our existing partners or potential partners... We are a global company, we have the capability to start projects in any region, and not necessarily with a partnership model," Benyan says.

Sabic was also ready to tap the credit market for funding as part of its strategy to diversify away from domestic raw material sources, he adds. Saudi-based petrochemicals businesses have benefited in the past from natural gas feedstock subsidies but the government in December decided to raise feedstock prices to bridge a budget deficit after oil’s two-year downturn. This has forced petchem firms to reconsider their business models, already hit by lower product prices due to the drop in the oil price.

"Sabic has a very strong balance sheet and I think we will be able to finance any project with the right model in order for us to leverage our balance sheet and the debt market as well," Benyan says.

While declining to give an investment amount for the petrochemicals complex to be jointly built with Exxon Mobil, Benyan says it would include the largest steam cracker in the world, and would constitute Sabic’s largest investment abroad to date. It has production sites in 20 countries.

|

Benyan ... leading the petrochemicals major efficiently |

Steam crackers, which feed on either oil distillates or natural gas, churn out chemical building blocks for anything from plastics, foams and coatings to solvents. For the chemical complex on the US Gulf coast, the two partners are targeting an output capacity of 1.8 million tonnes of ethylene, the world’s most commonly used basic petrochemical.

While reiterating that 2017 would be challenging year overall, the CEO rules out a drop in revenues:

"I don’t think that for Sabic we will have a sales decline... I think there will be challenges on the total demand but I’m confident Sabic has very strong competitive positions."

"Our business development group is looking at opportunities in China, looking at opportunities also in the US," the CEO says.

"I would wait probably 60 days to determine the size of the changes ... I’m confident we will bring Hadeed within Sabic in a stronger position when the market turns around."

Meanwhile, Sabic is using ‘Chemistry that Matters’ to address global trends and challenges in key industries with inspiring solutions.

That was the message Sabic brought to a global audience at K 2016, the world’s premier trade show for the plastics industry, held this year in Dusseldorf, Germany.

A growing global population – combined with a rapidly increasing urbanisation and middle class – is driving many industries to solutions for sustainable materials and innovative techniques to enable the construction of affordable, energy-efficient houses, personal vehicles, smart devices, consumer goods and modern, affordable mass-transportation systems, while contributing to the smart use of global resources.

To that end, Sabic strives to produce products that that are safer, lighter and affordable to a wide range of people. These products ultimately grow the economy in a sustainable manner – lifting more people out of poverty and into the middle class.

Sabic’s state-of-the-art booth highlighted examples from the petrochemical giant’s collaborations with customers to jointly develop and produce global solutions, from concept to realisation.

Focusing on providing answers to global challenges, Sabic demonstrated how these challenges can be turned into opportunities that achieve customer goals while creating lasting business value for them and for Sabic.

"Our customers are seeing their businesses evolve rapidly," says Abdulrahman Al-Fageeh, executive vice president for Petrochemicals.

"They are responding to technological advances, changing consumer needs, volatile raw material prices, new feedstocks, and new manufacturing trends. By providing new ideas and new solutions that help our customers achieve their ambitions and sustainability goals – we also achieve our own."

To collaborate more closely with customers, Al-Fageeh notes the establishment of a new, market-facing structure that targets key focus segments – including automotive, pipe, foam, mass transportation, health care, building and construction, and packaging.

"These are market segments where we see growth in coming years," he said. "A rising world population demands materials that are lighter in weight and more flexible than existing ones, yet are strong, durable and meet rigorous safety standards."

In June 2016, Saudi Aramco and Sabic signed a heads of agreement to conduct a feasibility study on the development of a fully integrated crude oil-to-chemicals complex to be located in Saudi Arabia. The heads of agreement contains key principles of cooperation that will form the basis for the companies to establish a joint venture. Derived from improved refining technology, the crude oil-to-chemicals process will involve innovative configurations with proven conversion technologies. This will create a fully integrated petrochemical complex which maximises chemical yield, transforms and recycles by-products, drives efficiencies of scale and resource optimisation and diversifies the petrochemical feedstock mix in the Saudi Arabia.

|

Hadeed ... part of the spin-off programme |

Sabic and Saudi Aramco can drive advances that will diversify the Saudi’s feedstock mix and make oil a viable petrochemical feedstock. Sabic is hopeful that its agreement to conduct a joint feasibility study on the development of an integrated crude oil-to-chemicals complex in Saudi Arabia will ultimately lead to a new era for Saudi, driving strong economic growth. This would substantially increase the production of oil-based petrochemicals and further optimising value across the entire hydrocarbons chain. Thus helping Sabic increase its capacity.

Sabic through its Home of Innovation growth initiative, also announced strategic marketing relationships with 40 global, regional and local manufacturing companies to promote the introduction of industry-leading technology into Saudi Arabia and the Middle East region.

Through the initiative, Sabic engaged companies that demonstrated an interest in growing their business in Saudi and Middle East region. Additional qualities included a respected and recognised brand, a desire to engage with Sabic strategically, and innovative yet commercially-available systems or products.

In addition to engaging the local and regional market through industry events and targeted collaboration opportunities, Sabic is building a Home of Innovation facility in Riyadh to provide meaningful market awareness and insight, foster collaboration along the entire value chain and showcase advanced product and materials solutions. The facility is expected to be completed in the first half of next year.

The collaboration with these companies to seek cost-effective, high-performance solutions that meet customer needs and increase demand for the design, manufacturing and purchase of new products in Saudi Arabia, would improve the company’s future revenues and also help the company in launching new products.

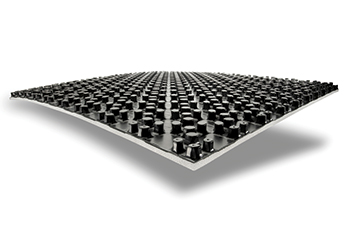

Sabic has a comprehensive chemical products portfolio addressing a diverse customer base. The company’s chemicals segment produces value-added chemical products. It manufactures hydrocarbon feedstocks (ethane, and naphtha, among others) which are the basic building blocks for manufacturing a range of other chemicals, plastics and advanced materials. It manufactures olefins and aromatics that are used to produce polyolefins and other polymers employed to make plastics, fabrics, and packaging materials.

Further, Sabic’s chemicals segment manufactures polyethylene, polypropylene, PVC, PET, thermoplastic resins, specialty compounds, film and sheet products, additives and intermediates and coatings. These products are further used by several industries including automotive, electronics, lighting and building, construction, healthcare, and transportation among others. Also, the company’s chemicals business segment manufactures performance chemicals (such as ethanolamines) that find their applications in electronics, automotive, personal care, transportation/aviation industries.

Diversified portfolio helps to differentiate the product portfolio and helps to cater to a large customer base, thus enhancing brand image.

Sabic has strong technology and innovation capabilities. On its technology and innovation, Sabic spent SR2,257.3 million ($601.8 million) in FY2015, an increase of 19.3 per cent over FY2014. The company is working on over 800 research projects that are expected to add value to its business and make a significant contribution to Sabic’s strategy. The company will focus on perfecting technology with the collaborators and on developing new technologies in-house. Sabic has ambitious patents targets: in 2015, the total patents and patent applications increased to 10,960.

In FY2015, Sabic renewed the joint development agreement with Cima NanoTech, continuing its joint efforts to bring the world’s first transparent conductive polycarbonate film solution to the consumer electronics industry. During FY2015, a fully functional 23-inch touch screen built on this technology was demonstrated at the IDTechEx show in the US and a 55-inch touch screen was exhibited at C-Touch in China. Sabic also introduced Lexan XHR2000 sheet, the world’s first and only truly transparent plastic sheet that meets strict aircraft interior requirements for heat release, flame, smoke, and smoke toxicity, while delivering the highest level of light transmission. This was the culmination of many years of technical and application development, which will revolutionise what is possible in cabin aesthetics and allow designers to create modern, light-filled cabin environments.

Sabic is engaged in the manufacturing, marketing and distribution of petrochemical, plastics, fertilisers, metals and basic hydrocarbon products. The company has a comprehensive portfolio of chemical products.