UN SDGs and their applicability to oil and gas

UN SDGs and their applicability to oil and gas

Petroleum engineers have a central role to play in reducing emissions and raising the awareness in their organisations about how this adds to sustainability goals beyond company borders, write Josh Etkind, Maria Angela Capello, and Florent Rousset

An engineer working in the oil industry generally dedicates her or his academic years and first 5 to 10 years of professional career to mastering certain traditionally core technical and digital skills. The ability to assess, minimise, and offset environmental and social impacts now must be added to the list of core competencies.

Even in the current challenging macroeconomic environment, we must carefully consider the total environmental footprint, and the carbon emissions profile of our activities and use this as an additional criterion to optimise portfolio decisions. Focusing on 'environmental' sustainability is critical for oil and gas 'industry' sustainability.

THE NEXT CULTURAL REVOLUTION

|

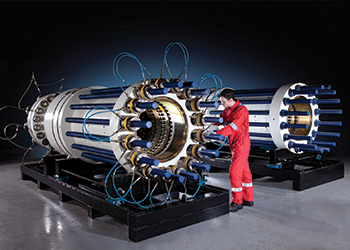

Petroleum engineers have a key role in reducing GHG emissions |

Our essential role in providing the energy to keep the global economy moving requires us to pay special attention to the 17 United Nations Sustainable Development (SD) goals. The following are especially relevant:

• SDG No 7: Affordable and clean energy.

• SDG No 13: Climate action on greenhouse gas (GHG) emissions.

• SDG Nos 14, 15: Life below water, and on land.

• SDG No 6: Clean water and sanitation.

Most of these topics are only lightly covered in most engineering curricula and have not yet been fully integrated throughout all organisations.

Oil and gas professionals can add more value to their employers and society by exploring, learning about, and applying these SD concepts to their daily work. There are numerous case studies proving it is possible to reduce environmental footprint of projects and assets while also improving bottom-line profitability. Examples include reducing methane leaks across the value chain and the inclusion of renewable energy resources and battery-power backup to increase uptime and availability while reducing GHG emissions from upstream, midstream, and downstream facilities.

Additionally, opportunities are emerging, often in partnership with non-governmental organisations and governments, to go beyond net-zero impact to regenerate the ecosystems around our operations. Increasingly, our license to operate, our industry’s profitability, and the shareholder value we seek to generate depend on our success in these areas.

Oil is a natural part of the ecosystem, and carbon dioxide (CO2) is a natural part of our environment. However, extractive techniques and industrial use have created an environmental crisis of global proportions well out of balance with natural systems’ ability to offset or recover.

Today, we are seeing increasing pressure from shareholders and institutional investors to do our important part to lead the energy transition. Initiatives such as the FSB Task Force on Climate-related Financial Disclosures will develop voluntary, consistent climate-related financial risk disclosures for use by companies in providing information to investors, lenders, insurers, and other stakeholders.

Large asset managers such as Blackrock have explicitly stated that sustainability considerations are central to their investment decisions, and they assess the resilience of issuers across a range of carbon pricing scenarios. Attracting investments essential to our industry increasingly requires a transformation of our business model and step-change improvements across every aspect of the oil and gas value chain.

FOCUS ON GHG REDUCTION

|

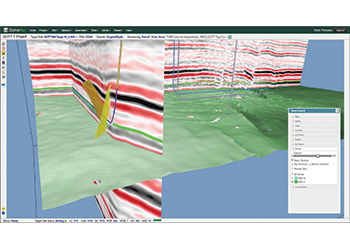

Yellow dots indicate 19 currently operating CCUS projects. The two orange dots are |

Our role in leading the drive for more sustainable development of oil and gas goes far beyond GHG reductions, but it is one of the areas directly in our control. Importantly, GHG emissions are often just a proxy for the efficiency of a process or system. By increasing the efficiency of that system, profitability will be enhanced if the investment to improve efficiency comes with an attractive return.

According to the International Energy Agency, 15 per cent of global energy sector GHG emissions are associated with oil and gas supply—about 5200 million tonnes (Mt). In exploration and production (E&P) activities, most emissions are associated with the venting, flaring, and fugitive emissions of natural gas, associated with the production of oil, which releases significant amounts of CO2 and methane (CH4) into the atmosphere.

While CO2 and CH4 have significantly different GHG impacts, their combined effects can be aggregated as a single unit measured in tonnes of CO2 equivalent (tCO2e).

Petroleum engineers have a central role to play in reducing GHG emissions and raising the awareness in their organisations about how this adds to sustainability goals beyond company borders.

According to the World Bank, 20 per cent of global emissions are currently subject to carbon pricing regulation, ranging from $1 to $139 per tCO2e with an average of $7 per tCO2e. Even in jurisdictions where no such carbon tax is currently in effect, E&P companies are increasingly applying a cost to their future CO2e emissions in order to factor this into project economics.

Many energy companies publicly support the Paris Climate Accords, referred to as COP21 (Conference of the Parties, United Nations Framework Convention on Climate Change), held in Paris in 2015, targeting less than a 2 deg C, and aspiring toward less than a 1.5 deg C, rise in global temperatures. Several supermajors, independents, service companies, and national oil companies have committed to reducing the carbon intensity of their operations and have set specific milestones describing their journey to carbon neutrality.

In order to blaze a trail to meet COP 21 targets, carbon capture use and storage (CCUS) has a critical role to play, but it won’t scale in time unless there is adequate policy support and we as an industry innovate to radically reduce costs.

Few countries have pledged contributions, or included CCUS technologies in their national determined contributions. Subsurface storage capacity is enormous, so subsurface, wells, process engineering, and project management skills can play an important role in imagining and realising a lower carbon future. Your creativity and fresh eyes are needed to make this work, and our industry is well-placed to lead.

The industry may also have a role in driving the adoption of nature-based solutions to offset our industry emissions. This may span many different sorts of solutions that leverage soils, trees, and other vegetation. How do we prepare to lead such projects or select from available options?

One of the leading inter-company initiatives helping to drive progress is the Oil and Gas Climate Initiative (OGCI). OGCI is a CEO-led consortium of 12 companies that have pledged to collectively invest more than $1 billion to accelerate the industry response to climate change. OGCI member companies explicitly support the Paris Agreement and its goals.

What other entirely novel pathways might we envision to restore the natural environment, and in doing so, create shareholder value and enhance our license to operate? What will competitiveness look like in our industry in 10 or 20 years from now? What new business models might emerge, new competitors, or new collaborations? How do we prepare students just starting their education to lead in such an environment? How can you serve as a potent catalyst for positive change?

• Josh Etkind is Gulf of Mexico digital transformation manager at Shell, and is based in New Orleans, Louisiana. Maria Angela Capello is an executive consultant for Kuwait Oil Company, based in Kuwait, and chair of the SPE BML Committee. Florent Rousset is the managing director for GaffneyCline, based in Houston.

This article was originally published in The Way Ahead, Society of Petroleum Engineers’ publication for young professionals in oil and gas (www.spe.org/twa).

.jpg)